If you are new to selling on Amazon, you might be surprised by the amount of fees and the complexity of the fee structure.

The main fees you’ll encounter are the referral fee (typically 6-15%), the $0.99 per item fee for Individual sellers, the $39.99 monthly fee for Professional sellers, and the “FBA fees” if you opt for Fulfillment by Amazon.

There are other fees you’ll run into though. The actual amount you pay will primarily depend on:

- Your account type (Individual vs Professional)

- Whether you’re using Fulfillment by Amazon

- Product category

- How long it takes to sell (if using FBA)

- Returns

This post will cover every Amazon seller fee, when Amazon charges you the fees, and how to calculate the fees in advance.

We’ll also cover strategies to help you limit the amount you pay in Amazon seller fees.

Want to learn more about getting your first sale on Amazon? We’re currently giving free access to our Get Your First Sale on Amazon ebook and our No-Debt, No-Stress Guide to Building a 7-Figure Online Retail Business to all subscribers. Learn more here.

Can I sell on Amazon for free?

There is no way to sell on Amazon for free, but you can set up your account so that you are only charged after an item sells.

This can be a great set up for beginning Amazon sellers who don’t want to test the waters before making a commitment to the platform.

The type of account you’ll need for this is called an “Individual Seller Account”.

You can read more about Individual Seller accounts and how to set them up here.

With that in mind, let’s talk about the first type of Amazon fees: account fees.

Amazon Account Fees

There are two types of Amazon Seller Accounts:

- Individual

- Professional

With an Individual Seller Account, there is no monthly account fee. You only “pay” once you’ve sold something, but there is an extra $0.99 per item sold fee with this account that isn’t charged on the Professional level.

A Professional account costs $39.99 a month, but it includes many additional features like the ability to get the buy box and use 3rd party software tools.

Amazon Referral Fees

Every item you sell on Amazon will be subject to a referral fee.

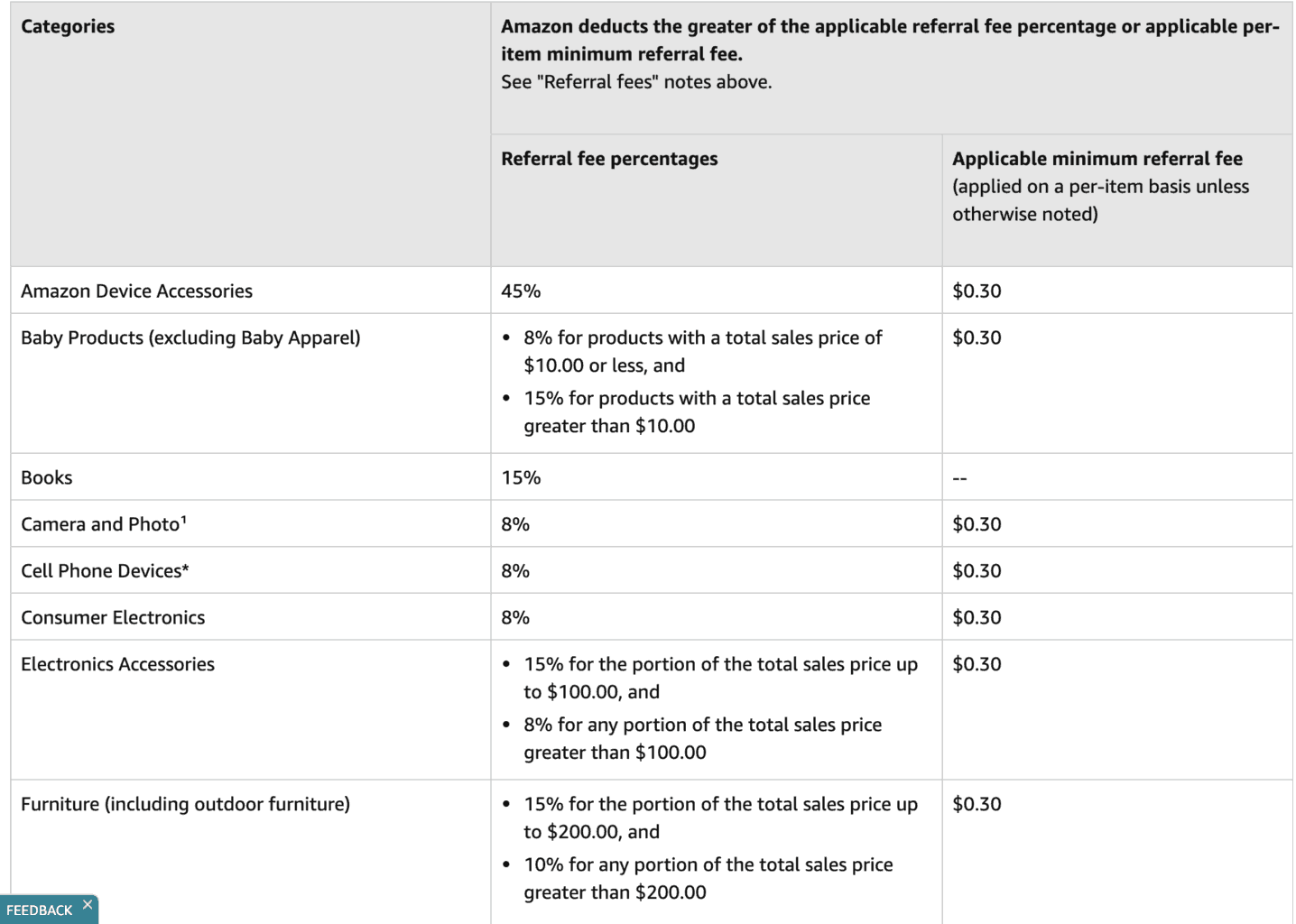

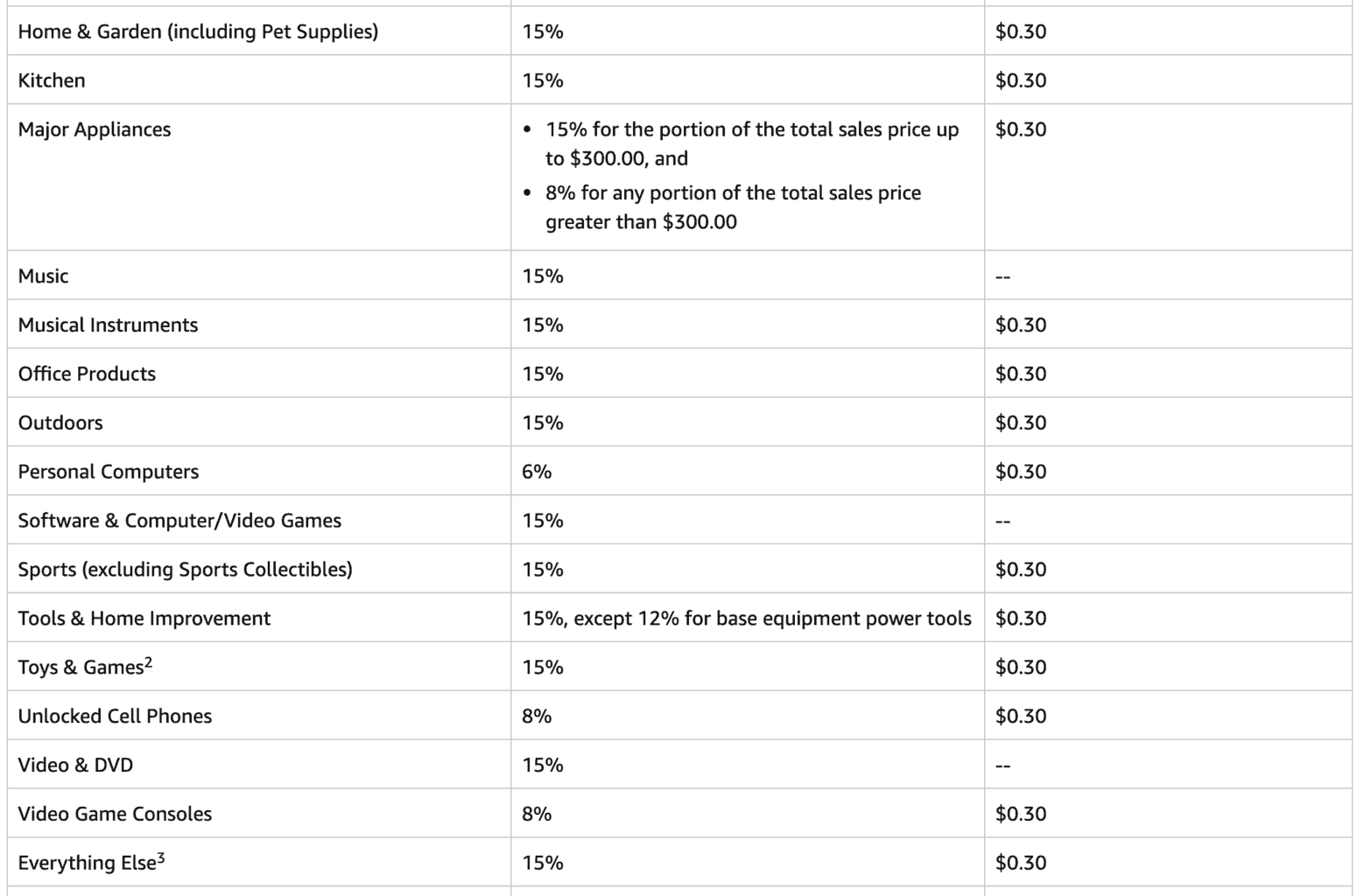

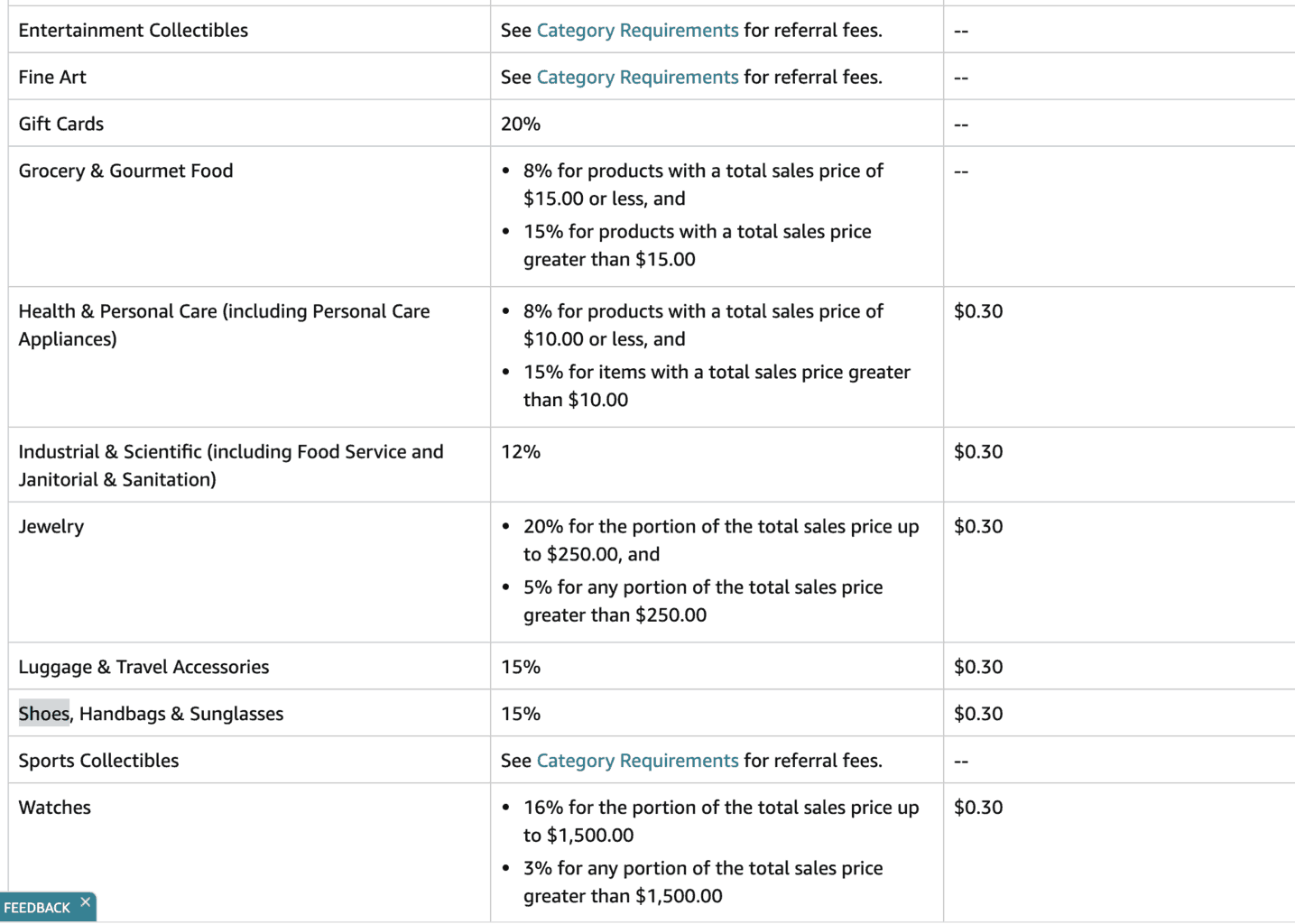

The referral fee is a percentage of the sale price that will be paid to Amazon as a commission for facilitating the sale. The percentage you pay is based on what category your item is in.

The Amazon referral fee will be between 6% and 15% of the sale price on the majority of categories that you are likely to sell in.

Here are screenshots of the referral fee percentages based on what category the item is in:

The referral fee is non-negotiable. There is nothing you can do to remove or limit it.

Amazon Closing Fee for Media Category

If you are selling items in the media category, you will pay a “closing fee” in addition to the referral fee.

The media category includes things like books, DVDs, music, and video games.

According to Amazon,

Sellers also pay a closing fee of $1.80 per media item that is sold. Media categories are Books, DVD, Music, Software & Computer/Video Games, Video, Video Game Consoles, and Video Game Accessories.

Refund Administration Fee

The next fee to be aware of is the “refund administration fee”.

The refund administration fee is only charged when a refund is issued to a customer who bought your product.

If you refund a customer for an order for which you have already received payment, Amazon will refund you the amount of the referral fee you paid for the item(s) minus the applicable Refund Administration Fee, which is the lesser of $5.00 or 20% of the applicable referral fee.

For example, if you refund a customer the $10.00 total sales price of an item in a category with a 15% referral fee, your Refund Administration Fee will be $0.30 ($10.00 x 15% referral fee = $1.50).

Fees Charged For Seller Fulfilled Items

The main additional cost that you will incur if you are seller fulfilling an item is the shipping cost to the customer.

While this isn’t technically a fee charged by Amazon, it’s very important to factor into the equation when evaluating items to sell.

You will be able to purchase shipping directly through Amazon for items sold and have it billed to your Amazon seller account. The cost of shipping directly to the customer will vary dramatically based on the size, dimension, and how far away your customer is.

Expect to pay between $4 and $15 to ship to customers for the vast majority of items.

FBA Fees

FBA stands for Fulfillment by Amazon. This is a program where you can send your products to an Amazon warehouse and have them handle shipping the items to your customers when they buy from you.

There are numerous benefits to FBA. Some of the big ones are:

- It saves you time.

- FBA unlocks Prime shipping for customers.

- More generally, shoppers trust the Prime logo.

But these benefits come at a cost. Here are the fees you’ll pay for using FBA…

FBA Fulfillment Fee

The main fee that you will be charged is the “fulfillment fee”.

This is the fee that is charged for Amazon to ship your item to your customer on your behalf. This fee covers the cost of the packaging, the time of the worker who handles putting the shipment together, and the shipping cost.

This fee will vary significantly based on the size of the item.

For example, if you were selling Monopoly Ultimate Banking using FBA, you would pay a fulfillment fee of $5.42.

This is a very good rate. If I tried to ship this item through the post office, I would likely pay at least $8.

Monthly Inventory Storage Fees

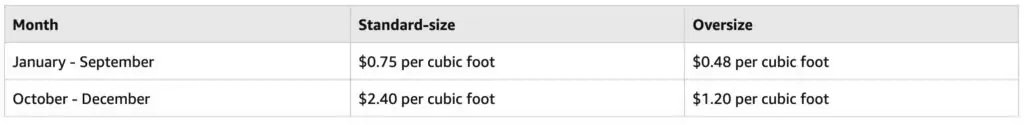

On a monthly basis, you will be charged storage fees based on how much space your items are taking up in Amazon’s FBA warehouses. You will be charged according to this schedule:

You’ll pay between $0.03 and $0.20 per month in storage fees for most items.

For a point of reference on this price, you would pay a $0.15 per month storage fee on the aforementioned Monopoly board game.

Long Term Storage Fees

On the 15th of every month, Amazon determines which items have been in their warehouses for 365 days or more and charges a fee of $6.90 per cubic foot.

This fee is essentially a tax on slow-moving inventory. The monthly storage fees are quite reasonable. The long term storage fees, on the other hand, get quite expensive.

The good news is that this fee is only charged on items that are in FBA warehouses for 365 days or more. If you are managing your inventory well, this should be an extremely small percentage of your inventory.

Cost of Inbound Shipping for FBA

Inbound shipping is the cost that you will pay to get your items to FBA warehouses. You are responsible for this cost.

The good news is that you will get Amazon’s partnered UPS rates when shipping to FBA warehouses. Most sellers pay around $1 per pound when first getting started.

Once you start to do larger shipments (100+ items), you will likely see your costs drop below $0.50 per pound.

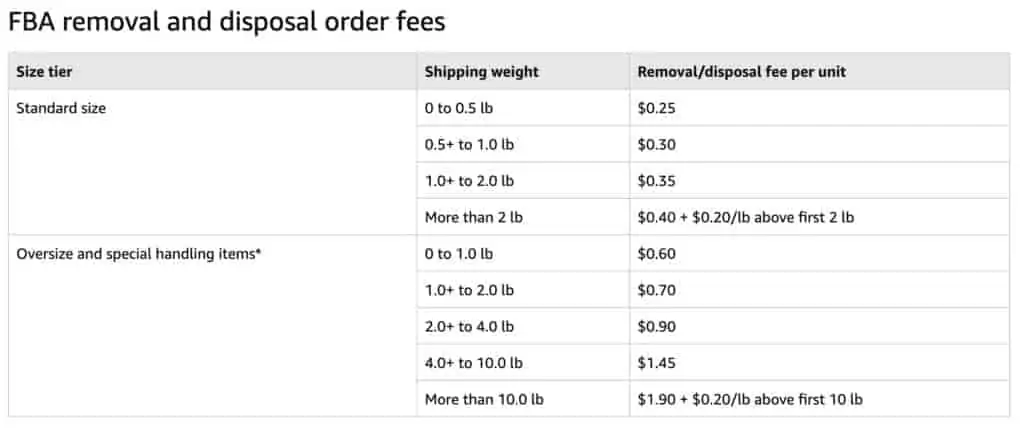

Removal and Disposal Order Fees

When you no longer want an item stored at an FBA warehouse, you have two options:

- Create a removal order and have the item sent back to you

- Create a disposal order and have Amazon dispose of the item for you.

Currently, the fee removing an item is the same as having Amazon dispose of the item for you. As a result, we always create removal orders.

The fees for this vary based on the size of the item. On the majority of items, you will pay less than $1 in removal order fees.

You can see the full fee schedule here:

Returns Processing Fee

This fee is only charged in these categories where Amazon offers free return shipping to customers: Apparel, Watches, Jewelry, Shoes, Handbags & Sunglasses, and Luggage.

The return processing fee is equal to the fulfillment fee you paid when the item was shipped to the customer. In most cases, this fee will be between $3 and $6.

Optional Service Fees

There are also many optional services that you can use from Amazon. As these are optional we won’t go into the full details in this post, but you should know they exist.

Optional services include: having Amazon label your products, using inventory placement service to be able to ship to fewer FBA warehouse locations, advertising through Amazon sponsored ads, and multichannel fulfillment fees to use your FBA inventory to fulfill orders on other platforms.

Amazon FBA Fee Calculator

You can calculate how much you’ll pay in FBA fees in advance by using Amazon’s FBA Revenue Calculator.

This calculator will show you how much you will pay in fees based on your expected sale price. You will also be able to calculate how much you will get paid if you seller fulfill an item, and compare that to using FBA.

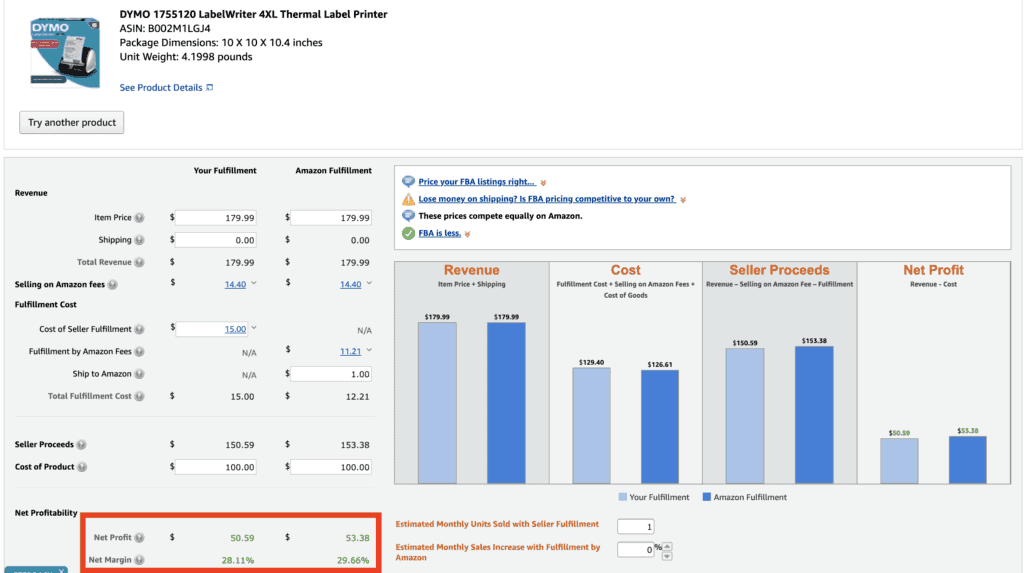

Here’s an example using the Dymo 4XL, which is the printer we use for printing shipping labels in my business:

As you can see in this screenshot, the calculator will show you the Amazon referral fees and the FBA fees. This amount will encompass the full cost of Amazon shipping the item to the customer on your behalf.

You will also be able to enter in your inbound shipping cost. This is the amount that you will pay to get the item to Amazon’s warehouses.

In the calculator, you will also be able to enter in the costs of seller fulfillment so you can easily compare the 2 options. The red box highlights the key numbers to pay attention to and can help you decide which fulfillment method you would like to use.

With a tool like this available for free, there’s no excuse not to know the expected profit on any inventory purchase you are making in advance. So I’d highly recommend using this tool, or a 3rd party version that has the same functionality.

Are the Amazon Seller Fees Worth It?

While it may seem like there are a lot of fees for selling on Amazon, they are more than worth paying in our experience. The vast majority – if not all – of the fees directly help increase our profits and revenues.

The key number that we pay attention to in my business is how much we get paid for an item when we sell it, compared to how much the item costs us. If we can make our desired profit and return on investment, then we have no issue with the Amazon fees.

The number of customers on Amazon is unmatched, so paying a fee to get access to them is a good idea in my opinion as long as you run the numbers in advance.

Why are Amazon FBA Seller Fees so high?

When you use FBA, Amazon does a lot of the heavy lifting and covers the most time-intensive parts of fulfillment. They also handle all the inventory storage. All of this costs money.

In our experience, FBA is almost always worth the investment. One of the main parts of the FBA fees is the fulfillment fee, and we often save money here compared to what it would cost to ship the item ourselves.

We always run the numbers in advance and make sure we’ll make our profits on the items we sell. As long as we can make our desired margin, we don’t worry too much about the fees.

How to Limit Your Amazon Selling Fees

Certain fees on Amazon are fixed, but there are still a few things you can do to make sure you aren’t paying any unnecessary fees to sell on Amazon.

Here are some things to watch out for:

- If you are selling over 40 items per month, make sure you are signed up as a professional seller.

- Keep your inventory moving quickly.

- Optimize your shipments to FBA warehouses.

Having a Professional Seller Account

Having a professional seller account costs $39.99 per month but will save you a $0.99 fee on every item you sell. With an Individual account, selling 41 items equals an additional $40.59 in per-item fees and it just goes up from there with every additional item.

In other words, a Professional Seller account will save you money as long as you sell more than 40 items per month.

Keep Your Inventory Moving Quickly

The longer your inventory sits at Amazon warehouses, the more you will pay in storage costs.

Remember, there are two types of storage fees: monthly and long term. Monthly fees are a normal cost of doing business, but you still want to strike a balance between minimizing shipping costs, minimizing storage fees, and making sure you don’t run out of FBA inventory.

Long term storage fees used to be charged when you had inventory in an Amazon warehouse for over 6 months, but in 2019 they changed this so that only inventory that has been in their warehouses for over a year incurs these fees. Long term storage fees should be easy to avoid if you are smart about product selection and management.

Optimize Your Shipments to FBA Warehouses

In general, the more items you send per box, the better the shipping rates you will receive.

Once you are shipping in many boxes at a time on a regular basis, I’d recommend looking into shipping via pallet to Amazon’s warehouses. This is known as LTL (less than truckload) shipments and can save you money on inbound shipping.

eBay vs Amazon fees

When you are deciding which marketplaces to sell on, the fee structure is something that should be factored into the decision. Amazon and eBay are the 2 largest marketplaces in the United States, so we’ll take a quick look at how to decide on which marketplaces to sell on based on the fees.

You can see how the fees work on Amazon throughout this post. For purposes of direct comparison we’ll begin by assuming on Amazon you will be seller fulfilling your items, as on eBay you will be responsible for shipping directly to the customer.

The Amazon referral fee is between 6% and 15% for most categories.

On eBay, you will pay what is known as a “final value fee” based on the sales price of your item. This fee is most commonly 10%, but you can receive a discount for being a top-rated seller. In addition to the final value fee, you will pay Paypal fees. The Paypal fees on the transaction will be 2.9% plus $0.30. So in total when you sell an item on eBay you will be paying 12.9% plus $0.30.

There are exceptions for select items on eBay. For example books, DVDs, and music are charged final value fees of 12%. Men’s and Women’s athletic shoes over $100 are not charged any final value fees.

Outside of those exceptions, the fees you will pay to sell an item on both platforms is quite similar. Let’s say you are selling a $25 toy. On Amazon you will pay a 15% referral fee, so you will pay a $3.75 referral fee. On eBay you would pay 12.9% plus $0.30 for a total final value fee of $3.53.

On an item like that the difference is not likely to have a major impact on where you sell your item.

But if you are selling athletic shoes over $100, you’ll pay only Paypal fees on eBay and you’d pay 15% on Amazon. So the savings for selling on eBay would be significant.

Or if you are selling a personal computer, you’ll pay a 6% fee on Amazon, and a 12.9% plus $0.30 fee on eBay. So in a case like this, selling on Amazon is likely the better option.

Overall the vast majority of the time, the fee difference between Amazon and eBay will be very small. My recommendation would be to evaluate the fees for your item on both marketplaces to help you decide where to sell your items.

In my business, if we make our desired return on investment after the fees, then we’ll sell the items on both platforms.

Questions or Suggestions?

If anything above was unclear or you still have questions, please let us know in the comments below.

We also appreciate any additional suggestions you may have for keeping your Amazon seller fees to a minimum.

Want to read more? Check out the following posts…

Thanks for creating this great articlew. I really enjoyed it. Susanna Hercule Chace

Great to hear you enjoyed it!

Best Regards,

Ryan