Today’s post will be about a topic I have received several questions on over the past couple of months. Most recently from Brent, here is Brent’s question:

“I have a question about adjusting prices on items I’ve sent into FBA. It seems that items I have recently sent in to FBA the prices have dropped even before my items arrive at the warehouses. Some of the items I send into FBA are clearance items from Target and Walgreens. Do you think prices drop on these items because they are on clearance at Target and Walgreen stores nationwide so there is more competition? How do you normally handle when something like this happens? Wait for prices to rebound after the competition has run out of inventory? Or lower your prices to try and get those items to move?”

This is a very good question and it is something that I have noticed as well on several items. Let’s take a look at 2 examples on Target clearance items that I have sold over the past few months where I have noticed something similar and then I will get into how I normally handle situations like this.

Price Drop Examples

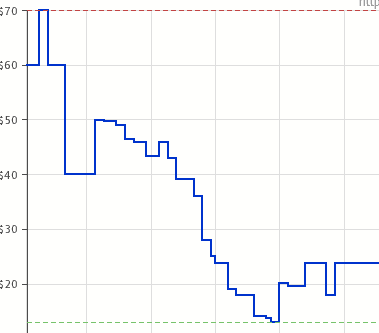

Example #1: Spy Gear Mission Extreme Kit purchased 6 on clearance at Target on January 4th, 2014 for $19.98 each. On this date the current low FBA price was about $52. Now let’s take a look at the camelcamelcamel chart for this item to see what happened to the price (click to enlarge):

The #1 on the the chart shows the pricing information on the day I purchased this product. The chart above shows the lowest price available at each date without factoring in the merchant fulfilled shipping cost. For example, if the low seller was 12.99 plus 4.99 for shipping, this chart would show the low price of $12.99. If the the low price was an FBA seller was selling for 12.99, it would still show the low price as $12.99. Make sure to keep this in mind when looking at these charts, as they give a good idea of the prices, but can’t be relied upon 100% for the aforementioned reason.

I ended up selling all of these for $35 each between March 28th and April 4th (#2 on the chart), which left me with a profit of about $6.28 after it was all said and done. If I would have sold at $52 (low FBA price when purchased) I would have made about $20.73 on each one.

Let’s take a look at a second example and then I will get into my reasoning for pricing as I did.

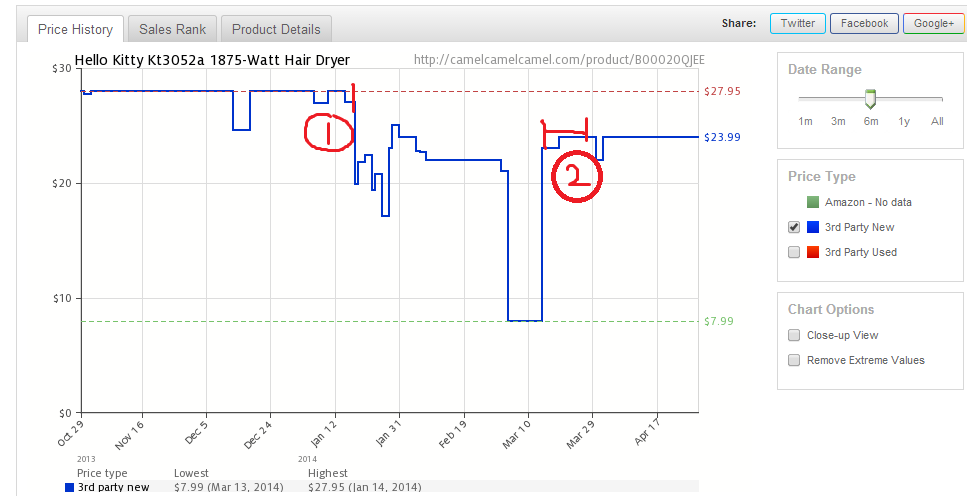

Example #2 Hello Kitty Hair Dryer purchased 5 on clearance at Target on January 14th for $9.98 a piece. The low FBA price at this time was around $31.99. Let’s take a look at the chart from camelcamelcamel:

As you can see from this one, I purchased at point #1, and ended up selling all 5 of these between March 10th and March 27th (#2) for $22.99 to $24.99 each. Selling at this price made me a profit of between $6.10 and $7.80 on each one, compared to a profit of about $13.75 a piece if I had sold at $31.99 (low FBA at time of purchase).

So example #1 it took about 3 months to receive about a 30% return on investment (ROI) and example #2 took about 2.5 months to see about a 70% ROI. In the end both of these turned into profitable situations, but it took a bit longer than I would have liked to get my money back.

Let’s get into my basic strategy with clearance items purchased from large retailers. First off, I know that they might be available nationwide and as a result available to a large number of resellers at the same time. Knowing this, I first like to purchase at as big of a discount as possible. Target for example normally follows a pretty regular markdown schedule along these lines 15% to 30% to 50% to 70% off the original price. This doesn’t hold true every time, but with clearance items at Target in general I am looking to purchase items at a minimum of 50% off the retail price. Both of the examples above were purchased at 50% off the retail price, and it’s important to know that some other sellers may have found these items for 70% off the retail prices. This would have been $11.98 on the Spy Gear item, and $5.98 on the Hello Kitty item. As you can see sellers purchasing at 70% off can sell at a significantly lower price to see a good ROI, compared to my purchasing at 50% off.

So step #1 is to be aware that the prices could drop and to be aware of any regular markdowns. After taking this risk into account, you decide to purchase the item. You list it for sale at the current market price, send it in to FBA, and the price starts to go down, now what?

Now it’s decision time. The main choices as I see them are:

- Sell at the current market price regardless of if you lose money or not

- Price at break even and wait for a sale

- Price at a level that is somewhat profitable and wait for a sale

- Don’t adjust your price at all and wait for a sale

It is very important to note with all of these options that it is not guaranteed your item will sell, or that the price will indeed start to increase.

Option 1 – I rarely choose this option at least initially. If after 3 or 4 months it appear the item is still something I am going to loose money on, then I will price it to sell and take the loss, but it’s not my first choice.

Option 2 – Again, I rarely choose this option. If I think the price will recover then I like to price in some level of profit as well.

Option 3- This is my most common decision when I see a price dropping significantly. When I see the price dropping significantly and to a level that is not profitable, I will try to find a price that I can sell at that will still make me a few bucks. In the items previously mentioned this was $35 and $22.99 to $24.99, respectively. I chose these prices by looking at the current product offerings listed for sale. Oftentimes there will be a group of sellers that are priced similarly that is a good amount above the current low selling price and at a level that would be profitable based on my buy cost. I normally price somewhere in this group, as if/when the lower priced sellers are out of stock, my offering will be competitive with the market.

Option 4- I will occasionally choose this option. If I think the price will make a full recovery I will sometimes hold out for my initial listing price, but not often. This is the riskiest option in my opinion. It is worth noting that the current low FBA sellers on the 2 examples above are now higher than what I sold for. So, if I would have held out longer I could have some additional money to show for it. The problem with this option is waiting a long time to get any money back on your investment.

Those are the options as I see them. I normally try option 3 whenever possible to find the balance of making a profit and still selling my item quickly. Getting cash in hand is very important, as this allows me to reinvest the cash in additional products to resell. You will have to determine which options makes the most sense for your business. I may dive a little deeper into some of the economic reasons for the price changes in a future post, but that’s for another time.

What are your strategies when prices start heading south? Please share your strategies, along with any other questions, in the comments below or send me an email at grant.ryanj@gmail.com.

My next post will be my April 2014 financial results, which will be published later this week, so make sure you subscribe using the form below so you don’t miss out!

Why not recall the item after60 days and return to store?

Hello,

I do not do this as I do not find it to be an ethical business practice. Also, if you continually return a bunch of items to one store they could potentially limit your ability to purchase from them.

I do not recommend returning items purchased for resale simply because they are not selling.

-Ryan

Here’s an interesting one: would you ever buy from Amazon itself to sell on Amazon if you thought they were temporarily discounting a product and will raise the price back to normal shortly? I’m tempted to do so with one product as their sale price is the same as other merchants had the product on sale, but worried that Amazon might not be following the same end dates as other merchants if they’ve only just got it in stock at the reduced rate.

Hey Sean,

Great question, and the answer is absolutely! I normally do some research using a website such as http://www.camelcamelcamel.com to confirm that it is a significantly discounted price, but I have done this before with some success. The only thing to note if you do this, is to not buy with your amazon prime account (if you have one) as using your prime account to buy items to resell is against amazon’s policy.

Best Regards,

Ryan

Hey Ryan,

I have a controversial question here. You mentioned in the last post that you don’t do the “return to store” route for ethical reasons. I agree but isn’t buying from Amazon to resell later on Amazon also questionable. Basically, this deprives customers of the low price so that they can pay more for the same item later. It is kinda like grabbing all the markdown items at a Target and then telling the customer who wanted some that I’ll sell it to her at regular price. I worry that at some point Amazon will strongly react against this as it provides no benefit to consumers (only helps the FBA sellers). I’m not writing with a better-than-thou attitude here but fear that widespread use of this would jeopardize FBA in Amazon’s eye. Your thoughts? Thanks

Hey LC,

You make a valid point. Currently, I am not overly concerned with it, and the main reason why is that amazon makes a commission on both sales. First when I buy an item, and then again, when I sell the item to the end customer. Most of the time the end customer is never going to be aware that the price was lower, and they will be happy to pay the current asking price. I don’t think buying on amazon to sell on amazon is likely to cause too many issues with customer satisfaction unless it is done on items that are scarce and a huge premium is charged above the retail price of an item.

As for buying out a markdown deal at Target, I have done this as well, and this doesn’t bother my personal code of ethics. The stores want the items gone, and I want the items because I know there are customers who are willing to pay a price that will allow me to make a profit.

That’s my take, but I would definitely be open to hearing yours and anyone else’s thoughts who want to weigh in further.

Best Regards,

Ryan

This is a great little lesson as I haven’t sold a thing in a month, and I wonder how much is due to the price I have things set at. I would love to see a post about how to read Camel Camel Camel effectively. I am not sure what it is even telling me. I checked the two items I have sold to date on there, I saw the dates that sold in the graph but they were not the price they sold for so it confused me. Maybe I am totally reading this wrong? A bit of help would be very welcomed in the three camels world. Thanks so much for all your efforts to date!

Hi Kim,

You are very welcome, that’s a great idea to include in a future post about how I use camelcamelcamel. More people need to learn how to effectively use the info in the three camels world 🙂

Best Regards,

Ryan

Great example here. Here’s an example from the UK of price changes recently: LOTR/Hobbit Lego have been on sale, typically half price or better. The sale is ending right now and anyway most of the stock sold out weeks ago. Amazon themselves very briefly got in on the sale but sold out within a few hours. Lots of FBA sellers, including myself, went for these products and bought a decent stock.

I’ve only just got started, but one retailers offer of not just half price on the lego but also giving away £20 in vouchers (roughly $33) for every £40 (roughly $66) spend meant that this was an opportunity too good to pass up and I put the equivalent of about $1k into it.

Price started to drop on Amazon pretty fast with FBA sellers competiting for the buy box. The sales ranks were good enough that a lot of us sold our inventory quite fast anyway – I think it took me about 3 days – but those who had bought more of the product then saw ever decreasing prices. Some of the margins (before factoring in inbound shipping and packaging costs) became as low as 10%.

However now that even these merchants are selling out prices have started to recover. I got some more stock for a merchant that was late to the half price offer and actually saw the FBA price increase from what it was when I bought the stock. My margins weren’t great – about 25% – but I knew from the initial purchase that they would sell fast, and they have – although I’ve still got a few in stock as I purchased larger quantities this time and they only were processed by Amazon on Sunday.

This is a little different to the target example: it wasn’t exactly clearance but a manufacturer chosen sale. I think in these instances in future it might be better to sit on the stock until the sale is over then send it to FBA (or if you’re low on storage like me send it to FBA, eat the storage fees, but wait until prices recover after the sale). I couldn’t do that this time as my business model currently revolves around a quick turn around because my cashflow isn’t great, so I aim for great sales ranks with profits of at least 20%. Seems to be doing ok – within a month or so of starting I’m turning over equivalent of about $3k a week of which about $1k is profit doing this just a few evenings a week, and I know if I had $20k in the bank I’d be able to double it in about two months at current return rates.

Hey Sean,

That’s a great example, and you make some great points here! I completely agree that waiting for the initial rush of sellers to sell out can be a viable strategy if you have the cash. Thanks for sharing!

Best Regards,

Ryan

Ryan,

Again another exceptional and very helpful post! Loved your concrete examples and thought process. As I am new game in this game, I haven’t got around to monitor the price war that closely. My repricing is somewhat random at this point when needed. I am sure down the road, I’ll need to establish a routine. Look forward to reading your result post for April!

Thanks much,

Lei

Hey Lei,

No problem, glad to hear you enjoyed it! My repricing strategies are still evolving as I gain more experience, but the ones outlined in this post are definitely the main ones I am currently using.

Best Regards,

Ryan