Today’s post will be the 6th month in an ongoing series of guest financial results posts. If you missed any of the first five, you can find them HERE.

Take it away Dana:

It’s that time again. I was reading back through the comments of last month’s post and there were some really good questions I thought I’d address there here.

Ryan S asked if I got hit with any brand restrictions. I’m happy to report that I really haven’t (at least not yet). I did notice some Vtech toys are now restricted, but not all. I don’t sell Legos so haven’t even checked those out. I’m still selling KitchenAid and other major brand kitchen items. I am more cautious with checking the seller app before buying stuff now – but I haven’t really noticed any issues. Probably because I’m not a huge volume seller…yet.

Also he mentioned something about adding cash back as part of my profitability. Some people like to consider that just ‘bonus’ and I suppose it’s how you use it in your business. For me, I use cash back as income that I put back into purchasing more inventory – so it’s real cash earned for my business. I don’t use it for personal spend. I also don’t consider it when I’m looking at the profitability of a product. So I guess I consider it a bonus in terms of profitability but it’s real money that goes into my bank account as income at the end of each month. Each person is different and I think it really boils down to how you use it. I do know that in terms of taxes it’s considered a rebate, so if you do include it in your profitability, you need to be able to break it out so you’re not paying taxes on it. I track it as Other Income so I can easily identify it.

David S asked where I mainly source – we started out nearly 100% online arbitrage (OA) with online stores and small specialty stores. I’ve started dabbling in retail arbitrage (RA) but it’s extremely hard where I live since it’s a 3 hours through the mountains 1-way to any major metro area – which means an overnight stay in a hotel when I go. I do have some wholesale accounts – but honestly have not found anything profitable with those yet. Going through their catalogs is extremely time consuming and quite honestly I need to find some help to give me more time in order to be able to concentrate on that. After Q4 I plan to really get serious about finding some wholesale accounts that I can use. Sticking with RA/OA makes me nervous. Wholesale has always been my plan.

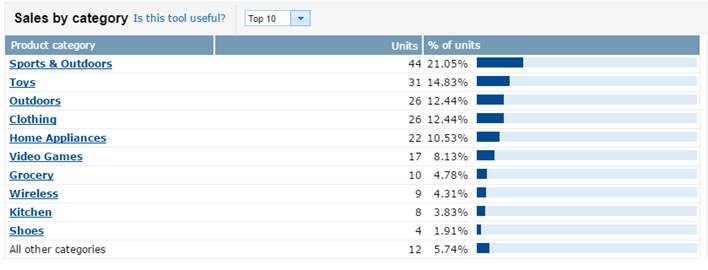

Chad asked what categories we sell in and what we sell on eBay. I sell in all categories I find profitable stuff in and that I’m ungated in. For me – it seems seasonal. I started heavy with kitchen, did a little toys and lately sports and outdoors. Here is a breakdown of categories for this month.

September Goals

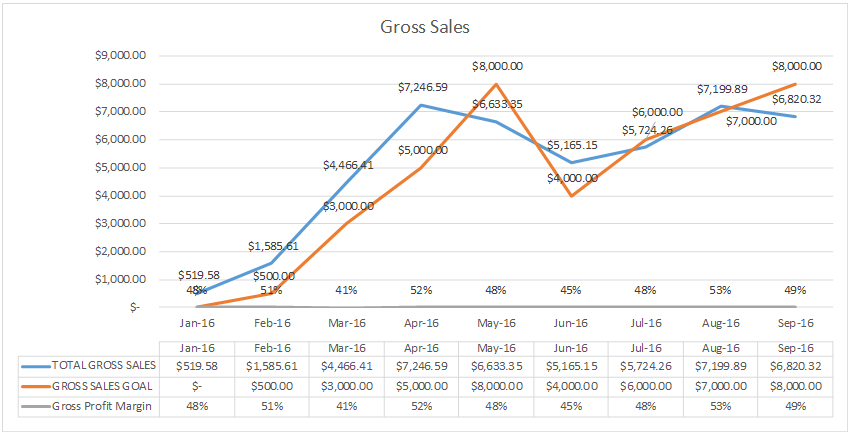

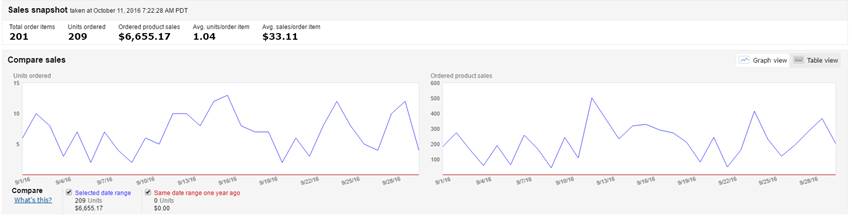

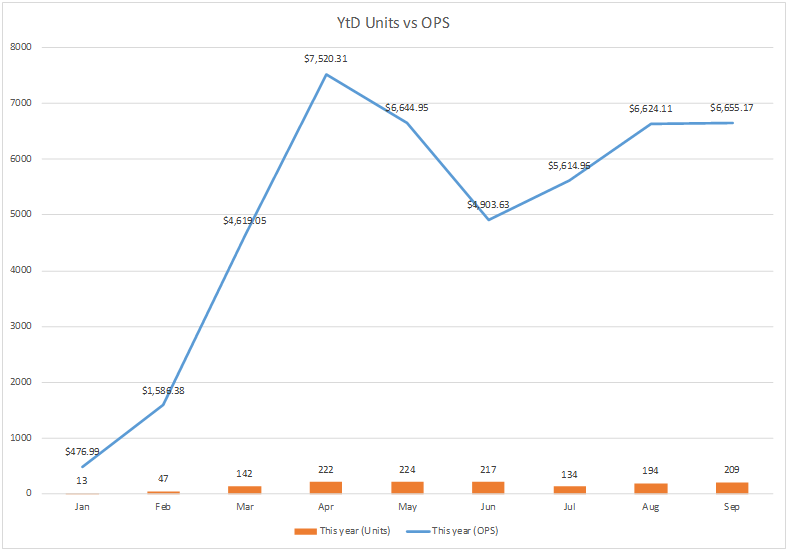

Overall September was just ‘ok’. I really felt the momentum of Q4 starting towards the end of the month so I was a little surprised when I ran the numbers to find we didn’t really sell as much as it felt like.

Goal 1 – Gross sales $8000 – We fell pretty short of this goal for the month. Again, it felt like we sold a lot more – with several double digit sales days in terms of units. But it was our 3rd best month to date – and giving my struggle to find inventory – I say I’m pleased. I know I sold a lot more on eBay this month than in the past.

So admittedly I haven’t completely finished the book, but I’ve started implementing some of the principles. I’ve moved from Quickbooks (QB) to Xero for accounting and started using YNAB for budgeting and cash flow management. I made the switch to Xero for a few reasons. First, I just didn’t really like QB Online for some reason. I then got QB Desktop and discovered there was no easy way to automatically download my transactions and there was no way to attach receipts to transaction via my phone. With Xero – the app works ‘ok’ and I can capture receipts while I’m out shopping. The cloud-based UI makes more sense to me and overall I find it easier. And it automatically syncs with all my accounts – including PayPal for eBay. I’m using A2X to automatically import my Amazon statements and OneSaas to integrate eBay. It’s cost a bit more – but my hope is that it will take much less time and help me be more organized. As far as budgeting I’m still using YNAB but being more diligent to update and track my spending. I created categories that correspond with Profit First and I budget out the appropriate amount each pay period.

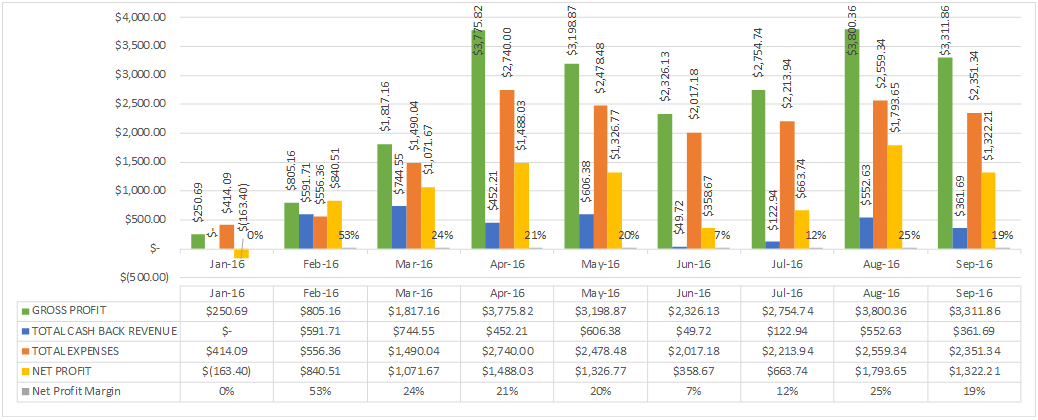

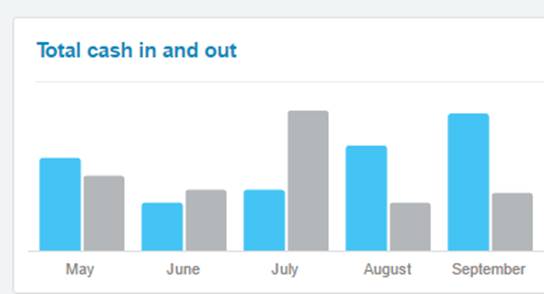

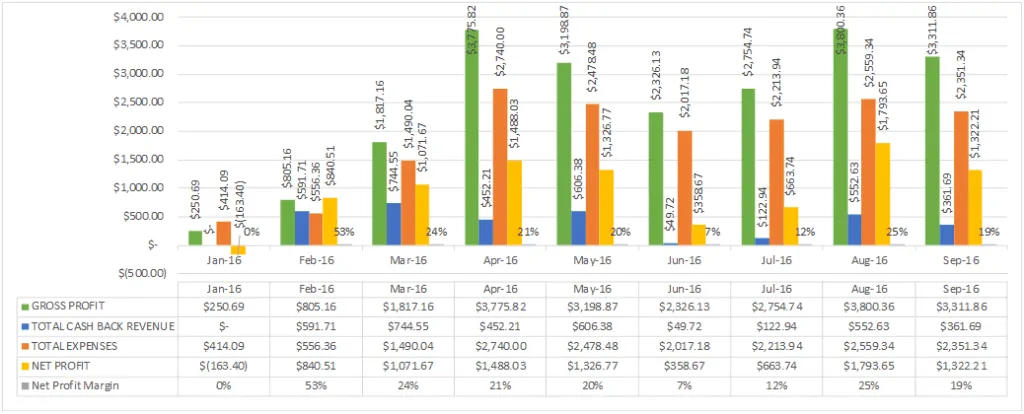

Xero tracks Cash In vs Out as does YNAB and here is a snapshot for YTD from Xero. It’s a little skewed for September giving that I brought in personal funds to help get back on track. But I think this will be useful going forward. Hopefully I’ll be able to provide some more context around the pretty bars next month. I think this graphically shows what I already knew about June and July. Those were not good months.

For a more detailed look at all my expenses, including my Amazon expenses. At the beginning of the month I took a hard look at expenses and decided to scale back on using my OA prep center. I was having increasingly more difficulty getting orders to go through. I had a few concerns on turnaround times and it was really cutting into my profit. The initial reason for getting a prep company was to help out during our move – so we could continue to buy and ship inventory. Now that we’ve somewhat settled, I’m doing all of the prep and shipping for now.

Note: click on the image below to enlarge to get a better look.

The services that are used that show up in the subscription fees section are OAXray for help with online arbitrage, InventoryLab for listing and accounting, TaxJar for managing sales taxes, BQool for repricing, and JoeLister for selling products on eBay that are currently listed on Amazon.

Goal 3 – Start preparing for Q4

As mentioned earlier, I can definitely tell things are ramping up as it feels like our sales have really increased. Which is a great thing until you realize you really need more inventory. My focus these past few weeks has been looking for people to help. I identified my 3 constraints (which are probably the same as everyone’s). a) lack of inventory b) lack of help and c) lack of cash flow. So here is my plan.

Inventory – I’ve joined a Q4 buying group where a small group of folks share hot buys – both RA and OA. Problem is I need folks close to metro areas who can go buy those items. My 1 Walmart and 1 Ace Hardware aren’t going to cut it. So I need to have a team of buyers who are located in areas where they can be on the lookout for these items.

Which brings me to lack of help. Giving that I just moved here and know only 6 people hiring help will be difficult. Also, hiring people located near me doesn’t really help in sourcing as there just aren’t stores. So I decided to hire back in Arkansas where I can get people I know and trust and who have access to a lot more stores. Friday I head back down south for the week where I’ll be meeting with and training 4 RA folks and at least 1 OA person – all either family members or personal friends. I’ve also lined up a local prep center who will let my buyers drop off merchandise and will prep and ship them within 24 hrs.

And finally cash flow. This one isn’t as easy as I’m pretty debt adverse so I really don’t want to take out any loans and I really hate paying interest. I’ve narrowed my options down to a) using personal funds from savings and b) leveraging a couple of 0% interest credit card offers I have laying around. Most are 0% for 12-36 months which is more than enough time to pay them back. I’m going to probably start with using personal funds to see how it goes.

I’ll post more on how building my team goes next month.

Goal 4 – Get ungated in Health and Beauty

I got approved for an account with a wholesaler who I’ve heard others were successful using. I did a brief glance at their items, but haven’t made a purchase yet. That is on my list for this week. I’ll post next month if it was successful.

So looking forward to Oct – here are our goals:

October Goals:

– Gross sales $7000

– Complete hiring and training process for buyers

– Ramp-up sourcing for Q4

– Get ungated in Health and Beauty

I’m trying to prepare myself for Q4 and just keeping down the fort. I expect the next couple of months are going to be mainly focused on buying and shipping stuff. I’ve got some items on my road map that I’ll be focusing on starting in January and another full few months dealing with personal stuff as we prepare to finish renovating our condo here in Colorado and start preparing to move back to Arkansas. Our move here was always temporary and the market is looking favorable for us to make the flip on our investment – so that should be fun 🙂

So one final plug, we’re going to be renting out our condo for the winter ski season starting in January with a 3-4 month lease option and then putting it on the market in Spring. So If you know anyone interested in spending the winter season living in and skiing the champagne powder of Steamboat – hit me up!

Until next month….Thanks for reading!

Ryan’s last words: Thank you Dana for putting this post together and sharing this update on your business!

“I’ve joined a Q4 buying group”

Where did you find out about this group?

Where could one go to find a similar group?

Hi, wonderful progress!!! How did you “line up a local prep center who will let my buyers drop off merchandise and will prep and ship them within 24 hrs.” ? What type of prep center? Can you give some pointers on what we can look for in our local areas? Thanks!