In today’s post I am going to share how to figure out exactly where the amounts on your Amazon 1099-K form come from. You will cross the Amazon 1099-K threshold if you are selling on Amazon and had more than $20,000 in payments processed on your behalf and had more than 200 transactions in the most recent calendar year. Otherwise, you won’t receive this form.

And yes, you need to report your Amazon sales on your taxes, just like any other income. To do that, this form will get filed with your income taxes to the IRS. If you’d like more details on why you are receiving the 1099-K and what it is for, you can find an explanation directly from the IRS HERE.

This can definitely be a confusing task for people who are just starting to sell on Amazon. And while it may seem daunting, there are only 6 numbers that we need to add up to see exactly what the total of our 1099-K form is, and all 6 can be found on the same report. In total this process should take less than 5 minutes.

How to Reconcile the Amazon 1099-K Form: Step by Step

Let’s get into the process of reconciling your 1099-K from Amazon. The first step is to access your 1099-K online. Here are the steps to access this form:

- Login to your Amazon Seller Account

- Hover over reports

- Select “Tax Document Library“

- Download the PDF of your Amazon 1099-K form for the applicable tax year

After you have downloaded the 1099, you can see the total amount of payments Amazon has collected on your behalf in box 1a. The number shown in box 1a on the 1099-K is likely in the ballpark of your total sales for the tax year, but won’t be exact. For the most recent calendar year, the 1099-K amount is about 6% higher than what my sales dashboard shows.

The next step is to run another report that will allow us to see exactly what amounts make up the Amazon 1099-K amounts. Here are the steps to access the next report:

- Login to your Amazon Seller Account

- Click on Reports via the left hand menu options

- Click on Payments

- Click the Date Range Reports tab

- Click Generate Report

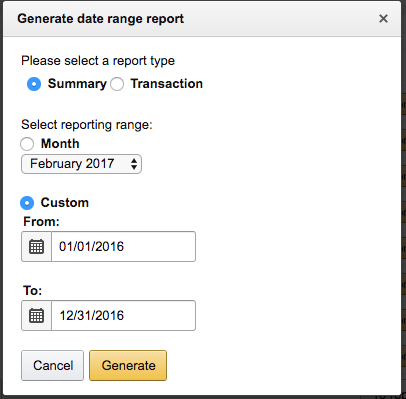

- Select the following settings, Summary, Custom, and enter the date range for the applicable tax year. Your settings should look like this:

- Click the Generate button

- Download the report after it has generated.

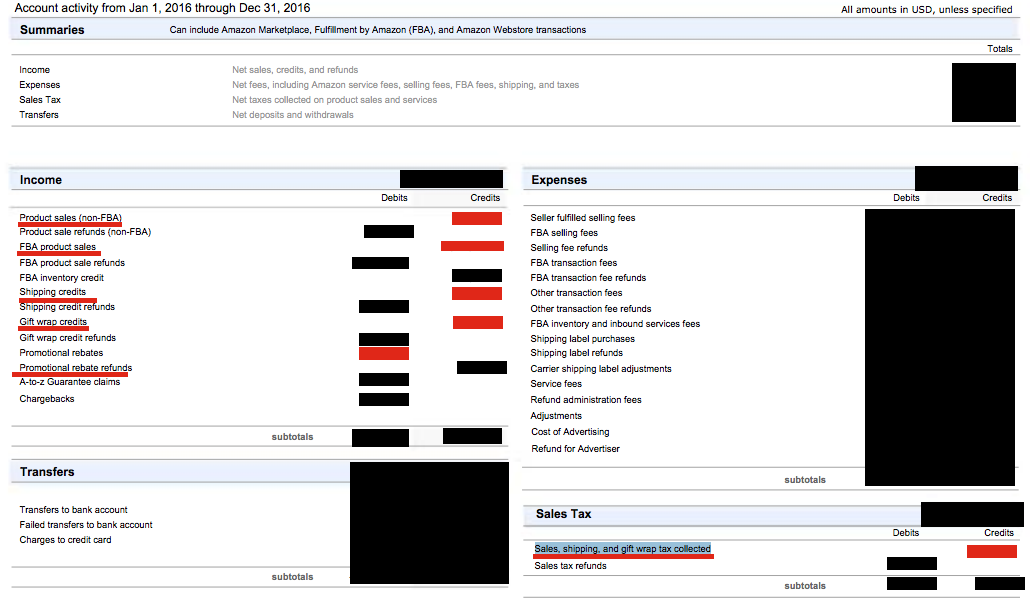

Once you have downloaded the report, there are a few specific numbers we are looking for. This screenshot below shows the specific numbers we are looking for. The items in red are the ones that we need to add up. Click to enlarge to get a better look.

The 6 numbers that you need to add up to reconcile to your Amazon 1099-K are as follows:

- Product sales (non-FBA)

- FBA product sales

- Shipping credits

- Gift wrap credits

- Promotional rebate refunds (Note: This will be a subtraction)

- Sales, shipping, and gift wrap tax collected

If you total up the above 6 numbers, this should match exactly to box 1a of your Amazon 1099-K.

Hopefully this post will help you, or your CPA, as you are preparing for your taxes. Taxes aren’t the most fun part of selling on Amazon, but they are an important thing to get right. This time of the year is a good time to reflect on what you can do in the future to lower your tax burden. One of those things is making sure that your legal entity is providing you the maximum benefit when it comes to taxes. If you aren’t sick of hearing about tax related topics after reading this post, I’d recommend checking out the post I did on the business structure I use for selling on Amazon. It shares how I use an LLC taxed as an S corporation to legally help lower my tax burden.

That’s all for this post. If you have any questions or comments, please share them below!

Thank you Ryan! As others suggested – this was the first post I found after a few hours of searching that CLEARLY explained how to match up the Summary Report to the 1099K. A miracle!

One question for you (first year Amazon seller) – is it accurate that the Income-Expenses-Transfers is the amount Amazon was holding undistributed from your Account at the end of year? Any good resource on whether that gets taxed as income (even though they haven’t paid it out yet?) Thank you!

Hi Evan,

Glad you found it helpful!

On your question, I’ve never checked that exact number. However, another way you could verify that is go to your payments report for the time period that overlaps year end. For example this could be 12/24 to 1/7. Then download all of the transactions that make up that payment. Then get the data into a spreadsheet and total up all of the transactions that are dated 12/31 or before. That should be the amount that was owed to you but not yet distributed.

Then in terms of if that gets taxed, I can’t give official tax advice as I’m not a CPA, but in my business we do account for that income in the year it’s earned regardless of it’s been paid yet. Discussing with a CPA what’s right for you would be the best advice I could give you.

Best Regards,

Ryan

Thanks for the detailed explanation.

Let’s assume that matched my 1099.

What number should my cpa start with and what exactly should I deduct? Using the summary report if course.

Thanks

Hi Asaf,

You are welcome. If you give all of this information to your CPA they should be able to know what numbers to start with. I’d recommend sending it along and letting them handle it.

Best Regards,

Ryan

Thank you so much!! FINALLY, a specific accurate step by step guide to matching up the 1099 to Amazon summary report. I searched all Amazon Forums for hours and no one explained it as simply and accurately as you. Really appreciate it!

Best,

Linda

Hi Linda,

You are welcome, great to hear it was helpful for you!

Best Regards,

Ryan

Thanks for the helpful write-up! Any idea id Amazon Pay is part of the 1099-K from Amazon. How the numbers will be structured with the Amazon Pay income?

No problem Danny! and unfortunately, I’m not sure how Amazon Pay factors in. This post is for someone who just has payments from Amazon through their seller central account.

Best Regards,

Ryan

Hi Ryan,

Kent here again. See last comment from last year. For some reason, this year the same technique didn’t work for me. Was off $296.00 even. Wondering if you were able to replicate the success from last year and match exactly or possibly was off a bit this year like me? Also last year you could download a summary report for the entire year. Navigating to the date range reports this year, you can only download in 180 day increments. I’m sure you were aware of this. You may be aware of this as well but just wanted to pass it along – on the seller forum, someone saved the link from the last year date range report location which magically allows you to download a full year again. Here’s the link if you are curious, https://sellercentral.amazon.com/gp/payments-account/date-range-reports.html/ref=sm_xx_cont_payments. Worked for me. All the best.

Hi Kent,

Thanks for the comment.

My CPA took care of everything for me this year, but I did see that change on how far back in time you can go with the reports. Thanks for sharing that “magic link” hopefully that will stay live for awhile.

Best Regards,

Ryan

Ironically, I had this question a few days ago and found the answer on the Amazon seller forums, maybe you found it there as well. You are correct and I can confirm mine matched up exactly after working through the numbers a few days ago.

I’m sure many Amazon sellers just hand over the summary report and 1099-K and expect their accountant to magically figure it out. Doesn’t work that way. Ryan, you deserve a lot of credit for putting this on your blog. It’s very important information. Why Amazon doesn’t spell this out on the 1099-K or in an addendum is reckless IMO.

Thank you! This has always been a mystery to me because my numbers never match their numbers.

No problem Monica, glad to hear it was helpful!

Best Regards,

Ryan