October is in the books, and Q4 is getting into full swing. That means it is time for me to share my financial results for October. If you missed any of my past financial results posts, you can find them HERE.

We’ll get started with some background information on how my time was spent this past month. From October 16th – 19th I was traveling to and attending the first annual ecom Chicago conference. I drove there and back from Minneapolis, and sourced along the way, so not too much time was lost over this trip. Other than that, I didn’t take any extra time off. I did have a friend begin working for me on a full time basis as an independent contractor. We spent about 2 weeks training, and shipping in items that I had backlogged. This time will not all be immediately revenue generating, but it should pay significant dividends in the coming months. For October, I averaged between 45 and 50 hours per week working specifically on the amazon results that I am sharing here.

Before we get to the numbers, there is one more topic to discuss. My goal with sharing my financial results is to show what can be done, and is not meant to be seen as bragging or anything of the sort. I want to show that working hard and sticking with your plan can pay off. If the results turn out to be poor at any time I will share that too.

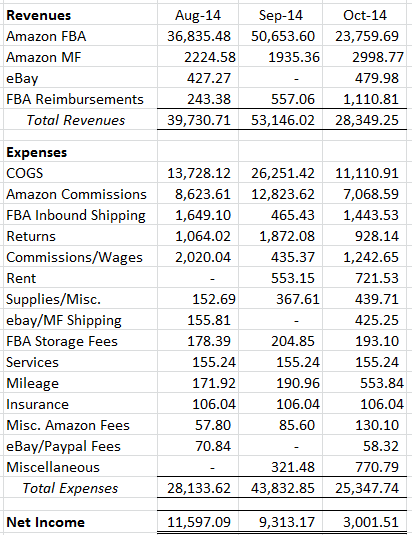

With that said, let’s get into the numbers for October. I want to provide as much clarity as possible into what I am doing on a month to month basis (if you have suggestions for additions to these posts, please let me know!). The numbers below are basically the profits that I am making for the month. The profits are calculated only on items that have been sold and shipped during the month. They were calculated by taking selling prices, minus all fees, minus all shipping and packaging costs, and subtracting the cost of the items. Certain important numbers such as: COGS, inbound shipping to amazon, customer returns, supplies, storage fees, rent, and services have been broken out separately. The FBA profits number factors in reimbursements from amazon for items lost or damaged at the warehouse. This will NOT be the exact number that goes on my tax returns as there will be additional deductions for cell phone, home office, etc. However, some of these are costs I would generally be incurring anyway, so for simplicity I will be leaving them out of the calculations. It’s also possible that I missed a receipt or 2 and the spending numbers may be updated slightly, but all numbers from amazon/eBay are 100% accurate. Also for clarity, this does not include any income from any other sources, it is simply my income from amazon and eBay.

October 2014 Financial Results

Notes: These are pretax income numbers and mileage has been calculated at the IRS rate of $0.56/mile. MF stands for merchant fulfilled and FBA is fulfilled by amazon.

This was a pretty significantly down month for me, which wasn’t completely unexpected. I had been spending my time on some very seasonal strategies during much of July through August and allowed my non-seasonal inventory to drop to lower than usual levels. Other factors contributing to the lower than usual profit are the amount of training wages that I paid to my friend who is now working full time as an independent contractor, the increased mileage going to the Chicago conference, and making some investments in the future of my business.

These investments included buying a Samsung Galaxy Tab and bluetooth keyboard to help speed the process of listing eBay items. I simply use the ebay app on the tablet, and then am able to type the descriptions, I have found so far that this speeds up the process of listing fairly significantly. In addition to this, I bought a security camera, and paid a friend to assist me in the approval process in the clothing & shoe categories on amazon. If you are interested in getting the contact information for this individual, join the Online Selling Experiment Facebook Group, and I will share his info there. All of these things brought down the immediate profits for this month, but I believe all will pay off significantly in the future.

Here are the current services that I am using that make up the above numbers:

Inventory Lab – I use their service for listing all of my products for sale on amazon, as well as the majority of my accounting. Current cost is $49.99/month, you can sign up for a 30 day free trial with no credit card required.

Scanpower– This is the primary scanning app that I use in retail stores. Current cost is $39.95/month, you can obtain a 1 month free trial by entering my email (grant.ryanj@gmail.com) when signing up.

Shoeboxed– This is a service that I use to manage my receipts. I send my receipts off to them in an envelope, they scan them into an online filling system, and mail them back to me. If you sign up through this link you can receive a 1 month free trial, and a 20% discount on your first 6 months if you become a paying user. Current cost for the plan I am using is $29.99/month.

UPS Smart Pickup – This is a service to have UPS pickup boxes from my house, rather than having to personally drop them off at a UPS location. Current Cost is $41.20/month.

Appeagle– This is new this month, and is a repricing service that I am using. So far I really like the results from using this as it will end up saving me a lot of time manually repricing. In addition, it reprices items up as well as down, so I have sold many items already for more than I have listed them for. They have a 14 day free trial, and if you enter coupon code “RYAN_G” you will receive 50% off your first month’s subscription if you elect to become a paying user. The current cost for this service for me is $25/mo.

Let’s take a look at my cash flow statement before I discuss my overall results:

Cash flow for the month was very significantly negative. This is due primarily to heavily investing in inventory, and the majority of these purchases were in the second half of the month. The cash inflows were down due to my inventory mix that I had going into the month, so the negative cash flow of about $27K is not unexpected. I am expecting to likely have net cash flow around zero and potentially negative for November as well. When my payouts related to December hit, that is when I am expecting to have significantly positive cash flow.

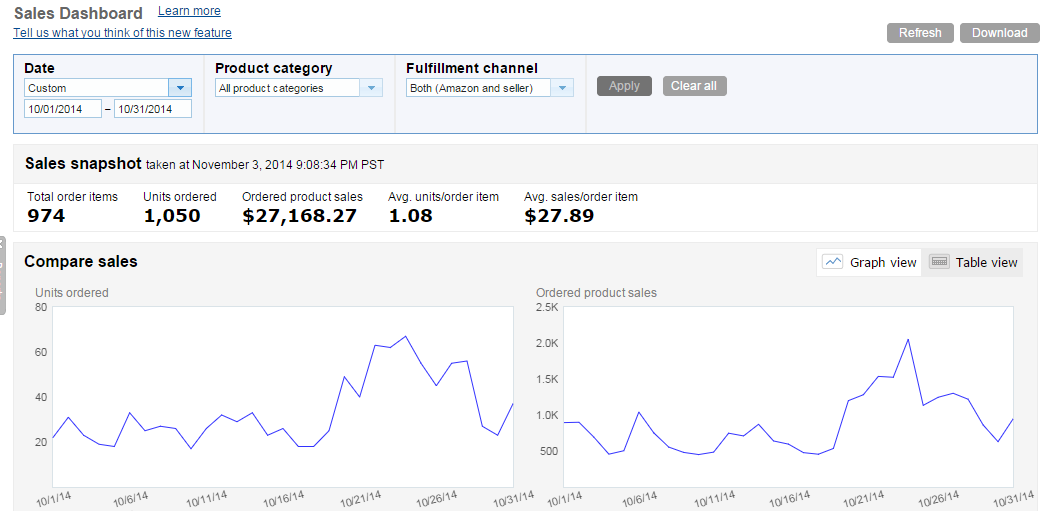

Now I will share some screenshots to provide some support for the above numbers I am sharing. Please note that the amazon sales number will not be exactly the same as what is shown above, as the screenshot below shows all orders that have been placed (but not necessarily shipped), while the above numbers are only for items that actually shipped during the month. Due to this the variance is to be expected:

If you want to see the breakdown of the product categories that comprised the $27K in sales, you can get a free one page PDF via email showing the breakdown by clicking the link directly below. Simply click this link and you can enter your email to receive the report.

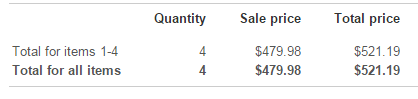

Now, here’s a screenshot from eBay to show those numbers:

Overall, my profits were a little lower than I would have liked them to be, but I made significant investments of both time and money that should pay off over the next couple of month and beyond. The negative cash flow number is also according to plan, and should be reverting to positive by the time I receive payouts from December.

Lastly, I have a quick announcement that I will be releasing a brand new project that I have been working on for the past couple of months this Friday. A couple hints are it’s going to be a website, and it’s going to provide more free content, but that’s all I can say for now. Check back on Friday and I will provide a link here on the blog!

That’s about all I have for now about October. My goal for November is to have my highest month in terms of both sales and profits this year, so stay tuned to see if that happens. If you have any questions or comments, please share them below!

Hey Ryan, love the blog! My wife and I are just getting into FBA. Actually we just sent in our first boxes this week.

We came across what seems to be a great deal, but being new, we’re not sure how many we want to buy.

The item is ranked 11,663 in Arts, Crafts & Sewing (it was 6,000 yesterday) and is selling for $49.99. We can purchase them for $16 with a coupon. We purchased about 40 of them today and we’re thinking of purchasing more while they’re still on sale.

Is that a good idea? What would you do? There are 4 other FBA sellers and Amazon is not currently selling them. We just don’t want to invest $1-2K in product that’s going to sit for a long time. If we were to purchase more than our current 40, how long should we expect it take for them to sale?

Keep up the good work. Love seeing how you’re crushing it!

Hi Michael,

Thank you for the kind words and sorry for the slow response! Without knowing more about your personal business goals/situation it is hard to say. Personally I would buy between $1-2K in this product as that is the amount I generally like to get on products that appear to be quality that I do not have a prior history with, assuming the discounted price is only available for a limited time. If this deal is likely to be available often I would buy less, and if it is a one time deal I would err on the side of buying more. I sell very little in the Arts and Crafts category so any guess I would provide on how long it will take to sell through would just be dangerous, so unfortunately I can’t advise on that.

Hope that helps!

Best Regards,

Ryan

Thanks for the response, Ryan. We ended up sticking with the original 40 pcs ($640 investment) and have sold a couple already. It looks as though this item does go on sale from time to time so we’ll have to keep an eye on it.

Hope Q4 is shaping up well for you!

Hey Ryan,

It does look like a down month to me compared to what you did the last few months, but if you are investing in inventory like you say you are that means your November payouts will be better.

I’d still say $27.89 is a pretty good average sales order for the volume you are doing!

Why are your FBA reimbursements so high this

month even though your FBA revenue is lower than last month?

Thanks,

Randy C.

Hey Randy,

November will definitely be better, hopefully much better 🙂

As for the reimbursements, it just had to do with the timing of amazon damaging and reimbursing for items. So, no real cause that I am aware of this month.

Best Regards,

Ryan

I have a question about the dollar amount you show for the returns on ebay and amazon. Is that the dollar amount that was refunded to the customer or the amount deducted from your account? The cost of the item? How is it calculated?

Hi Karen,

That is the amount that is deducted from my account.

Best Regards,

Ryan

Hi Mike,

You need to put the 2 products in the bag, and then label the outside of the bag. Just be sure the UPCs on the products inside the bag are covered as well.

Best Regards,

Ryan

One more question for the group re: shipping/labeling —

I have two individual items that will be sold as a single 2-pack.

I was planning on putting both items in a poly bag.

My question is: do I have to label each of the 2 products, and then just place them in the poly bag?

Or do I have to label each of the 2 products, AND then also label the poly bag?

Or do I NOT label either of the products, and only label the poly bag itself?

Sorry for the basic question — I Googled around and could not find it.

Pretty new to your blog Ryan but will definitely be sticking around. With the info you share it helps inspire me and teach me but also gives me more reason to root for you and get excited in your adventure :).

One-ish question I have as far as your numbers, what aspects of a product makes you decide to Merchant Fulfill rather than FBA? And I guess choose ebay over FBA as well. Your MF numbers are usually low compared to your FBA so was curious why you continued MF at all. As well as ebay, are you cross listing items or do you only use ebay to list things liked damaged boxes or collectibles and such? Although I’m only a few weeks into FBA I find I am already too spoiled/lazy to want to have to deal with ebay or fulfillment at all now lol. Probably a bad and non-profitable attitude but just seems like so much extra work now heh.

Really excited to see your next few months as I do think your investments (both inventory and time/infrastructure upgrades) will definitely pay off.

Thanks for sharing!

Hey Ron,

Glad to hear you enjoy the content, I will be sure to keep it coming! I do think the results for the next few months will be exciting, but time will tell.

As for your question, I think this post I did will give you some insight on how I make my decisions on where to sell items: https://onlinesellingexperiment.com/should-i-list-my-item-for-sale-on-amazon-or-ebay/

Best Regards,

Ryan

Thanks Ryan. Yep, that answers it ans was about what I was assuming. Thanks for the insight!

I have a few earbuds “listed” and sent in that went “inactive” (blocked) and I’m thinking it is a manufacturer kind of thing (Bose and Monster). They are brand new but I wasn’t able to list as new so I listed as used-like new and they seemed fine until they went inactive. Not much info for me as to why from Amazon unfortunately. But I’m thinking now that I should just try to sell them on ebay and have amazon fulfill them since they are already there lol.

Thanks again for the reply. Have a bit of reading to do to catch up on older post and likely answer any other questions I don’t know I have yet lol.

Hey Ryan,

I just ran across your site and I LOVE it — great stuff!

I am just starting out with FBA and I have a question related to the “3x” theory, the idea generally that you should only buy a product if you can sell it for 3x what you paid for it. (I understand this is only a guidance, not a hard and fast rule).

The company I work for sells consumer products, and I get a pretty great discount on them, but some of them don’t hit the 3x threshold. For example, I can buy one product for $5.00 and the Amazon price is $14.07. Another I can buy for $5.30 and the Amazon price is $14.33. There are a few others in the same general price ranges.

My question is: are these margins something you would consider chasing?

I know they’re somewhat on the lower side, but one thing to keep in mind here is that my time/effort expended “finding” these products is essentially zero — I simply walk over to the company store, and purchase them, that’s it. (How much volume I’ll be able to get is another story). So there really is no effort in sourcing on my end.

I’m definitely going to purchase a smaller amount, because I want to get my feet wet with FBA anyway and see how it goes.

But I’d be curious to hear your thoughts on this situation and what you would do.

Cheers,

Mike

Hey Mike if the sales rankings are pretty good and Amazon is not one of the sellers I would hit that if I were you. That is pretty close to 3X and you are getting it with very little time invested. It is also depends on how much they weigh for your inbound shipping, if they are light and you can buy a crapton of them it starts to go in your favor. Also, since you work there you know the product well and can improve the listings and list any items that are not on Amazon yet. It is worth a try at least, I’d buy about 3 of each and send them in and see how fast they go. The only thing I would leary about if is if Amazon is selling on the listings already, I have a hard time competing against Amazon unless I can really get my items for cheap.

Hey Paul,

Thanks for the reply — much appreciated!

Of the products I intend to start selling initially, it looks like Amazon is not in competition for any of them (at least not currently). They are competition for another product, but I’m not chasing that one yet as it costs me $6.65 and sells for $14.94, so I’d rather focus on more profitable items.

Of the 4 items I intend to target initially, two have a sales rank of under 5,000, while the other two are under 30,000. They are not heavy items, either.

I’m going to give it a shot and see what happens. My only potential issue could be how much volume I’d be able to get — while I don’t believe it’s against company policy per se to buy from the company store and flip it, I’m not sure it’s something I want to be too obvious about either by showing up to the store 3x per day and raising any red flags 🙂

Hey Mike,

Those are definitely margins I would consider. I think your plan to buy a few and see how they do is good, and then buy more if they sell well. You’ve probably already considered this, but I would just make sure that reselling them is allowed so you don’t jeopardize your current job.

Best Regards,

Ryan

Hello Ryan

Can your new Samsung Galaxy be used with software such as neatoscan where you download the amazon database for scanning where there is no wifi or cell connection

Thanks

al

Hey Al,

My plan is to try out Asellertool with the galaxy tab on Thursday actually. I will try to remember to report back to this comment with how it works, if not please feel free to reach out and I will let you know how it works.

Best Regards,

Ryan

Unbelievable #’s. It’s really hard for me, as a part-time eBay seller, to remember the differences in gross sales on eBay vs. Amazon. I see a lot of Amazon sellers who post unbelievable gross sales, but have to remain grounded in the fact that COG is so much higher when doing retail arb. Still great to see someone crushing it, regardless of the venue!

Thanks Chris! The sales screenshots definitely don’t tell the whole picture, as this month proves. My sales number was pretty high, but only about 10% ended up as profit.

Best Regards,

Ryan

Thank you for your willingness to share. You are such an inspiration to me!!! Can’t wait for the big announcement Friday.

Thanks Sonya!

That’s a pretty hefty negative cash flow Ryan! I’m sure it will pay off in the upcoming months. Is all of that totally bootstrapped (i.e. no credit)? If so, that gives a pretty decent indication of how much in assets you’ve grown since you’ve started. Kudos!

Hey Chris,

Indeed it is! So far it has all been bootstrapped and credit card balances have been paid in full every month. I am planning on financing some inventory that will be purchased this month, but for last month it will all be paid in full again.

Best Regards,

Ryan