Update September 2020: As you prep for Q4, don’t forget to sign up for our BOLO groups while there is still room! We’re also running one more Challenge starting September 28!

—

Hope everyone’s 2015 is off to a good start. I am getting back into the swing of things after taking it a little easy the first half of this month. I often share the positive aspects of the business through my monthly financial results posts, but this isn’t the full picture, so I am going to do a post today that shares a few of the bumps in the road. If you are new to selling on Amazon, hopefully seeing some of the mistakes I made can save you from similar mistakes in the future.

We’ll get into some specific examples soon, but to get this started I ran a report in InventoryLab to find out how many items I sold at a loss during the 4th quarter of 2014. In total there were 287 items that I sold for a loss during this time period, and the total amount lost on these sales before factoring in any prep or inbound shipping costs was $1,572.88. In addition to these items, I sold 127 items that ended up making $1 or less in profit, so after accounting for prep and inbound shipping costs, most of these are break even at best.

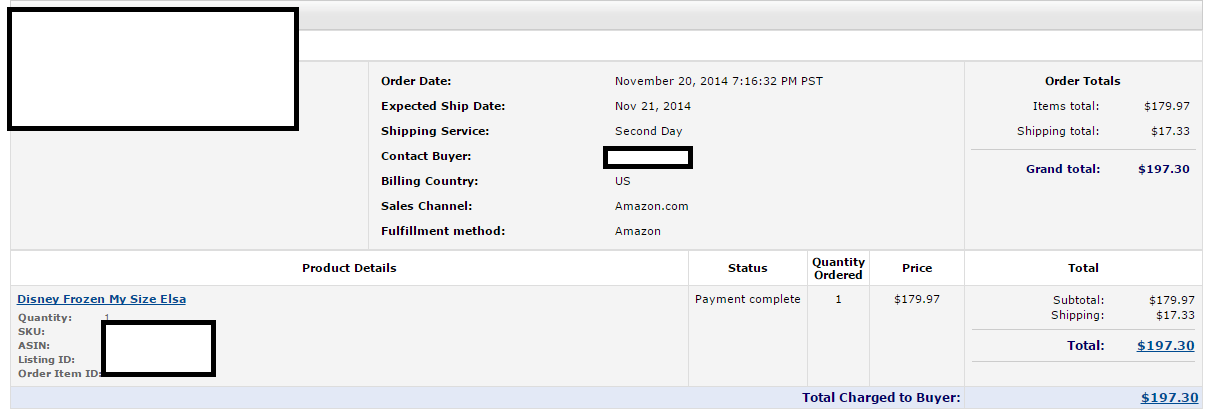

The biggest loss I took on a single item was on the My Size Elsa Doll that was a Target exclusive, and the regular price was $59.99. In early November I was only able to find 4 and sold each of them for right around $180, here’s a screenshot of one of the sales:

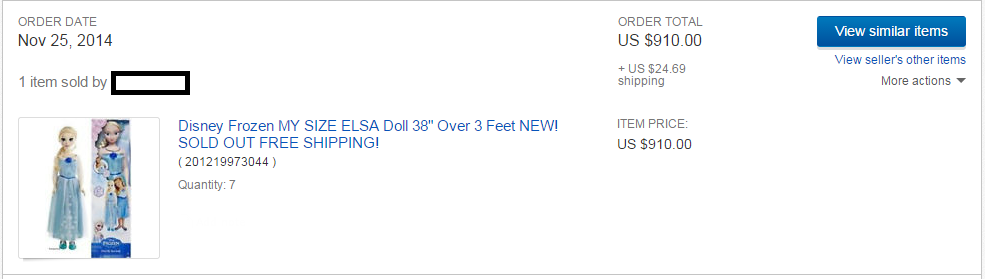

So, the first ones that sold did quite well. The problem arose when trying to find more. I had called and personally been to many of the Target stores in my area looking for more of this item in late November and was unable to locate any, and checks to other stores in the area came up empty as well. I spoke to managers and associates at several different stores and they indicated that all signs pointed to them getting very few more in before Christmas. Based on this information, I predicted the price would rise on amazon as Christmas grew closer. I based this on anticipating low supply, and increasing demand. So based on that, I made this purchase for 7 more of the dolls on November 25th: So I paid about $133 a piece for these after the shipping charges. I requested the Target receipt from the ebay seller to ensure I had proof of authenticity in the event of a customer claiming counterfeit issues. At the time I purchased them the low FBA price was right around $170, and I calculated that my break even point was at $172 after inbound shipping. I only needed a slight rise in prices close to Christmas to see a small profit, and I thought a significant price increase was possible. Seeing as I had already sold 4 of the dolls for $180, I felt that this was a reasonable play. So after I made the purchase here’s what happened to the price:

Q4 2014 Selling Mistakes

Things didn’t go quite according to plan. I set the minimum price on my repricer a bit above $200, and waited for the price to spike back up, but it never happened. The chart above shows quite clearly that the price fell significantly throughout December. Due to not monitoring my repricing closely enough I didn’t even get these 7 out the door until January. I sold them all between $80.16 and $91.99 a piece. Selling at $80.16 results in a payout of $59.77, so before factoring in inbound shipping, the biggest loss on one of these 7 dolls was about $73. So in total on these 7 I lost about $450.

This was quite a speculative play, and success wasn’t guaranteed as the result obviously shows. I am going to use this as a learning experience and exercise more caution before making a similar purchase again. The other piece that I will keep in mind is that if I see the price starting to trend downward I will consider quickly cutting ties with the item before it bottoms out. I would have had the opportunity to sell for $110-$130 in the week prior to Christmas, which still would have been a loss, but it would have recovered significantly more cash.

This leads into another mistake that I made quite a few times in December, and that was simply being too greedy on items. There were many instances in which I could have locked in profits by pricing to sell in early to mid December, but I held out until the last week, and my items never sold at the prices I was listed at. This resulted in me continuing to hold the items and wind up selling for a significantly lower price as opposed to locking in a modest profit in early December. This will show up to some extent in the January results post, as I did sell off some losers over the past few weeks. The moral of this story is that sometimes you need to lock in modest profits, and not be greedy and go for massive profits. When doing the latter, you will sometimes have to deal with the consequences of selling at a significantly lower price than you could have.

Another item that I would consider a mistake during December was not focusing on repricing enough. Prices change dramatically in Q4, and being on top of repricing can make a big difference. As with the item above I definitely left some money on the table, and there were quite a few others like this. Next Q4, I will be dedicating more time to repricing strategies to ensure I lock in profits on the highest percentage of items possible.

The last mistake that I will be sharing for today is that I was charged several credit card late fees as a result of missing some payment due dates during December. There were 3 different cards that I missed the due date on and was charged a late fee. In total the fees and interest were over $300. I was able to call each company and get most of the fees and interest waived, but it took a good amount of time to contact each one. The issue wasn’t that I didn’t have the money available to pay the bill, I simply didn’t realize the due date had come and gone. This might seem ridiculous and irresponsible to allow this to happen, and it probably is, but in the midst of the Q4 rush it can happen.

The main takeaway for me on this last issue is to have systems/reminders in place to ensure that important details, such as credit card payments, are handled. This is especially important during Q4, as at least for me, many nonessential items get neglected. I am now in the process of getting all of my credit card due dates changed to the same day, and I have put a recurring reminder in my phone each month to make sure I pay them off on time.

Those are just a few of the mistakes I made in Q4 2014 that I was able to come up with after thinking for a few minutes. I am sure there are many more mistakes that I have failed to include. I am not afraid of making mistakes as when I do I gain experience, and experience is one of the greatest teachers. I will learn from each of the above that I have shared to avoid similar pitfalls in the future.

Hopefully seeing these mistakes I made will save you from a similar one in the future. If you made any mistakes that you are willing to share, post them in the comments below!

Pingback: How to Account for Customer Returns when Selling via FBA whether or not you use InventoryLab

Ryan, Can you brief if you have any SKU naming strategy?

When I started, I used to follow this pattern for SKU- Store-Date-Purchase price. The purchase price used to help me the lowest I can sell and helped in quickly repricing.

But then when new stock comes in with a different price, this was creating an issue. So I stopped putting the price in my SKU.

So whats the best way to monitor the inventory and purchase price (Book keeping)? Do you use excel? any suggestions.

Hi DV,

For bookkeeping, I use InventoryLab. You can find a link to it as well as all of the services I use on my resources page here: onlinesellingexperiment.com/resources

As for the MSKU strategy, my default is my initials, and the date I listed it for sale. I really don’t get too elaborate as InventoryLab tracks most everything for me.

Best Regards,

Ryan

Great post. I get asked quite often from people if I ever lose money on items, and have plenty of examples similar to what you’ve shared. Not everything works out.

On the credit card payment consolidation scene, I take a slightly different approach. I stagger the due dates, then roll through them based on which card has the longest time to statement closing date. It’s a way to gain a few more weeks of interest free money. Plugging your cards into Mint can help with due date reminders, but it’s not really an ideal site for business purposes.

Hi Ed,

That’s a good call on the credit card strategy. I will have to look into something similar, as I am planning on managing/watching cash flow much closer this year as compared to last year.

Best Regards,

Ryan

Hi Ryan,

Love your article and website. Thanks for sharing and you were actually very specific on the item you made a mistake on. I remember starting out on eBay 4 years ago selling miniature perfumes. I didn’t price them right and thought I was making money. Unfortunately, after selling all of my inventory and calculating it I took a loss of $500. This was a while ago when I first started out and it was very discouraging but I definitely learned so much from the experience. I can totally sympathize with you. Keep up the articles as I love reading them when I get some free time. 🙂

Thank you for the kind words Jenny! Glad to hear I am not alone in taking losses 🙂

Best Regards,

Ryan

1.) How many hours do you spend sourcing per day? How many times per week?

2.) Do you source at big stores like Target, Wal-mart, and etc?

3.) How many of each item do you usually purchase?

4.) Do you scan all items throughout the store when sourcing? Is there a particular type of items you usually look for? Do you just go to the clearance section?

Hi Zacharie,

If you read through some of the older posts here on the blog, I believe you will find answers to most of these questions.

Best Regards,

Ryan

Hey Ryan,

I recently sent you an email thanking you for getting me into FBA through your website and haven’t heard back. I understand you’re a busy guy 🙂

I was generally emailing because I was wondering if you’d have any use for contracting a person such as myself to source on the East coast? I’m in the Virginia area and have lots of great stores around.

Hey Ryan,

I am a little behind on email at the moment (and often am) but I should be able to get back to you in the next few days.

Best Regards,

Ryan

Chiming in to say thank you for your transparency. My biggest mistake in my first Q4 was my emotions. It really ticked me off when someone returned a $100 photo scanner because it didn’t have a SIM card in it. Oh yes it did..it was factory sealed. So the buyer just stole the SIM and returned it for a significant loss to me. I paid for Amazon to send it back…now what do I do with it? I know they’ll be cheaters out there but I tell myself at least I don’t have to deal with shoplifters like the brick and mortars. Trying to accept this is a normal part of being a seller.

Wow, Grado, that is terrible and I’m so sorry that happened to you. I really appreciate you sharing your story because that’s a risk I had never thought about.

I just don’t understand how some people can live with themselves after doing awful stuff like that. Even if you were a “big box” store it’s still not right.

I wish you a year of great success.

Ree

Hey Grado,

Sorry to hear that, unfortunately sometimes as sellers we have to take losses on the items. They still hurt, but hopefully we have more “wins” to make up for the occasional bumps in the road.

Best Regards,

Ryan

I’m still smarting from a mistake I made recently… purchased two cases of Nivea lip balm – 100 units for $100… Well I didn’t read the product description well enough:

https://i.imgur.com/A8BlZ7j.png

ended up with $100 dollars of expired product.

Thanks for sharing Liam! Unfortunately I have made mistakes on expiration dates before as well.

Best Regards,

Ryan

hey Ryan– just started reading your blog about a week ago. stumbled on it just googling fba stuff. love it. awesome info, and extremely valuable. I just started selling via fba about 3 weeks back, just read articles online and figured what the heck, so im brand new- ive done lots of reading thus far, and your blog is by far the most value add Ive seen.

on another note, My best friends brother went to Winona st too- love it up there.

Nick

Thanks for the kind words Nick!

Best Regards,

Ryan

Great article. I was wondering if your credit cards take automatic payment. I set all my credit card to automatic payment and never have to worry about it as long as there is money in my account.

Hi Samuel,

That’s a good point about automatic payment. I believe they all do. Thus far I have avoided the automatic payment so that I can verify all of the charges before paying, but I might try out the auto pay method. Thanks for the tip!

Best Regards,

Ryan

Ryan,

I set it up to autopay only the minimum. If you pay it off before or make an early payment, it should not do anything. It’s just a safety net. Not all cards let you do this, but most do. I’ve made this mistake enough times to know better. Still do it sometimes when I get a new card and forget about it. The best solution is a consistent process.

Sounds good, thanks for the info Chris!

Appreciate you sharing your mistakes Ryan, as we learn as much or more from “what not to do” posts as we do from “what to do”. Most of the toys I sent to Amazon in Q4 (after much researching and CamelCamelCamel, etc.} quickly tanked, with dozens of sellers appearing just after I purchased. Many people said to hold on and wait for others to run out, but that didn’t work for me, and I can’t even sell many toys at a loss that are still in my inventory. I did well in other categories though. I think the Q4 toys game is not for me in 2015. Too risky like stock market.

Thanks for sharing Laura!

What are your preferred credit cards to put all that spending on and why?

Hi Jordan,

With the exception of store specific cards here are my top 3:

Capital One Spark – 2% cash back on all purchases

Club Carlson Visa – Rewards add up quickly, and any time you redeem points for a stay that is 2 nights or more, the last night is free.

AMEX Gold Business Card- This one is actually a charge card, so it has to be paid in full each month, but it still provides rewards. The main reason I use this one is that it has a very high limit. The limit on it isn’t set yet (it adjusts based on spending) but I was able to put over $25K of purchases on it in December.

Hope that helps!

Best Regards,

Ryan

I love your transparency, Ryan! Mistakes are the breeding ground for success 🙂

I was a bit greedy on a few of my listings as well (my perceived value didn’t match the market’s). That cost me and now I’m approaching the inventory being aged 6 months or longer. Yuck!

Here’s one of my blunders from 2014:

I picked up some Coppertone Faces SPF 50 at the 99c Only stores early last Summer. I bundled them into multipacks and shipped them off to Amazon’s warehouses. To my delight they flew off the shelves. Nice. I went back and cleaned out every 99c Only store in driving distance.

Got them packaged and sent off…and yep, they sold, too. But within weeks they started getting returned. What the corn flakes was going on???

I asked Amazon to send me a picture of one of the returns and sure enough, it turns out that in my haste I grabbed the SPF 15 and was inadvertently selling them as SPF 50. ACK!

I decided to have Amazon destroy all the inventory I had to avoid ruining my seller rating. It wasn’t worth having the product shipped back, spend the time to repackage and the cost to ship back to Amazon.

Moral: Failure = 1, Valuable Lesson x 1000.

Thanks for sharing that learning experience Ree! I have had that happen to me a couple of times too.

Best Regards,

Ryan

Fantastic post. Its always a positive thing to reflect on whats happened so you avoid making the same mistake twice. Its a very humbling experience and I admire you for putting it out there for others to see! It gave me things to consider.

Glad to hear it TC!

Great post Ryan. I feel you on the credit cards lol. A target red card here….a Kohls charge there…it can be hard to keep track. I really appreciate you sharing the mistakes here. I had to take a few losses as well Q4 but over all it was very profitable :). Would love to hear more about re-pricing strategies this year too.

Thanks Alex! I will definitely planning on sharing more about repricing strategies this year.

Best Regards,

Ryan

@ Alex

1.) How many hours do you spend sourcing per day? How many times per week?

2.) Do you source at big stores like Target, Wal-mart, and etc?

3.) How many of each item do you usually purchase?

4.) Do you scan all items throughout the store when sourcing? Is there a particular type of items you usually look for? Do you just go to the clearance section?

Sounds just like a stock – goes up and down – isn’t it? 😉

Yes, it’s a lot like investing in stocks! 😉

Hi Ryan. I really enjoy your blog. I’m just getting started in FBA, and you’ve given me a lot of great ideas.

We’re both accountants by education, and as such, we’re similarly interested in the financial analysis of our businesses. I’m enjoying your detail.

I’ve come up with a system for recurring reminders in Evernote, and I depend on them heavily every day. Perhaps you and your readers can benefit from it. I’ve blogged about it here:

https://www.troyeckhardt.com/2015/01/28/recurring-to-do-items-in-evernote/

It seems we also have similar tastes in themes. 🙂

Thanks for sharing that link Troy, I will have to test out your method!

Best Regards,

Ryan