Today’s post will be the fourth month in an ongoing series of guest financial results posts. If you missed the first three, you can find them here HERE.

Take it away Dana:

It’s that time again – time to recap how last month went. For those following along – June was pretty bad and while July is better – we’re still recovering from letting our good inventory run a bit too low. But important thing is – we’re now heading in the right direction.

July 2016 Financial Results

Here were our goals for July:

July Goals:

– Gross sales $6,000 with a target gross profit margin of 40%

– Meet goals in Spending Challenge ($8,000 spend at least 50% ROI & $400 Cash Back)

– Refine daily, monthly processes and document my plan for building a team

– Complete Inventory Sourcing Course (this is a course I purchased that I still need to complete)

– Close on our house, move everything else out and drive back to Colorado.

Let’s see how we did.

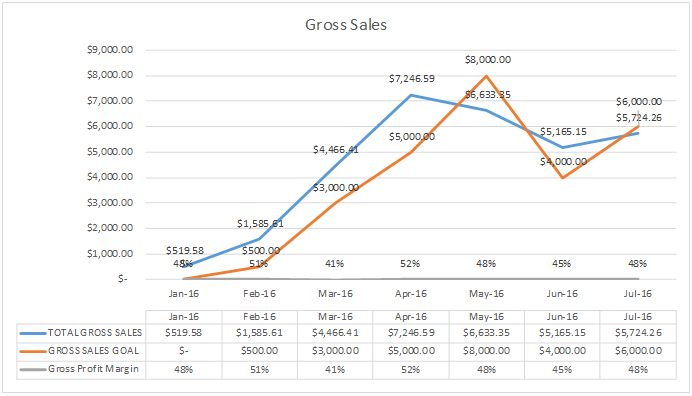

Goal 1 – Gross $6000 in sales with Gross profit of at least 40%

I wanted to specify a specific profit percentage to help encourage better sourcing and pricing. Now that I’m using a prep center, my expenses have increased and I want to make sure I account for that by sourcing items with a higher ROI. Note: click to enlarge this image or any others included in the post.

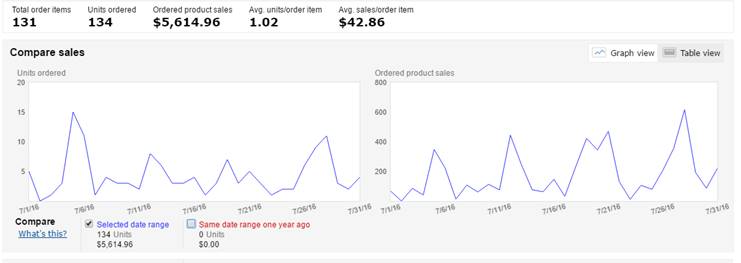

You can see here we just missed our Gross Sales goal by about $275. But we hit our Gross Profit Margin goal of at least 40% – and actually exceeded our goal by 8% – so very pleased with that. We were able to increase our profit margin from last month by sourcing better and higher average cost products. Below shows our average sales/order is over $40 compared to last months $25.95.

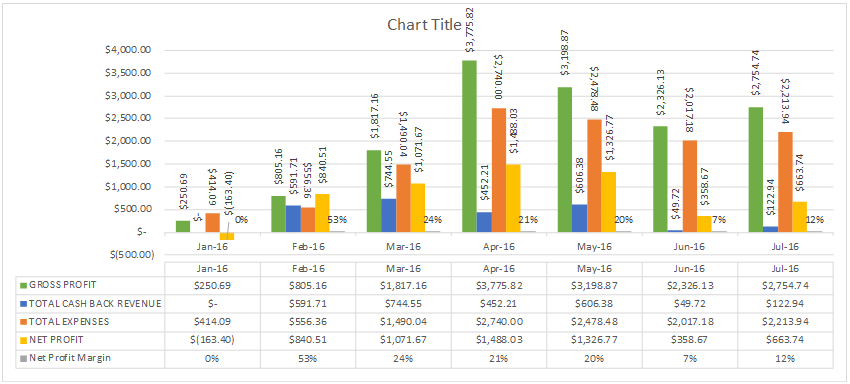

One thing I realized this month is that I have not been including in my overall profit numbers revenue from cash back portals and discounted gift cards. I’ve updated my numbers to include this additional revenue and I think you’ll agree – this is a pretty big deal at the moment. I don’t consider cash back or discounted gift cards when calculating my ROI while making buying decisions – so any money back is just gravy. But you can clearly see – that’s a lot of gravy when we take the time to do it.

You can see below that our first month we made more in cash back than our expenses and to date we’ve added over $2500 to our bottom line. As for this month – my overall net profit was around 12% and we only made a little over $650. Not great. So we need to really buckle down and figure out how to get those numbers back up.

For discounted gift cards I primarily use Raise.com. I use them because I like being able to have all my gift cards in one place. They have an iPhone app that shows all your gift cards and their balances. Unfortunately, it doesn’t automatically update the balances – but you can easily update them via the app. This makes it pretty easy to balance your cards. I treat them like any other cash account and reconcile them each month. You can also purchase them through the app which makes using them while in a store a snap. In my experience they are delivered within a few minutes of placing the order.

For cash back portals – I use cashbackmonitor.com to find the portal that is offering the biggest cash back rate. This site also lists any travel/mile point portals and credit card portals so you can compare across the board. I have a few top CB portals I use and sometimes they might list a portal I haven’t joined yet as the top payer. My only advice is stick to some of the more well-known portals as some have questionable payouts. You don’t want to have a couple of hundred dollars tied up in their system and never get your payout – which I’ve heard of happening. For tracking my CB balances, I use awardwallet.com – which also is a great app for tracking any travel miles credit cards and frequent flyer accounts. It can also track your CB portal balances so you can quickly see when you’ve reached the threshold to request payouts. Also don’t forget you can get cash back for some of your discounted gift card purchases too.

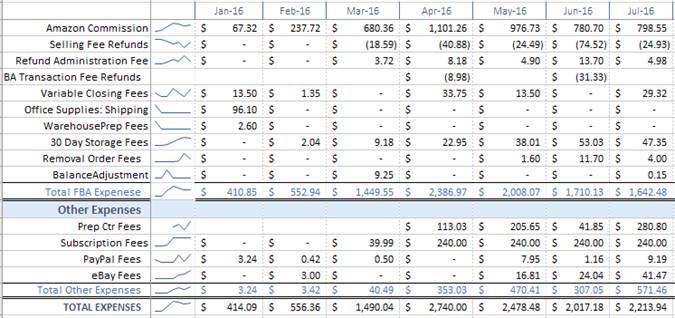

Here is some additional detail on our expenses. I’m having a bit of heart burn on the prep center fees. While I am including those fees when I’m sourcing products – it definitely having an impact in my overall profitability. Of course – so would be having to do all the prep work myself instead of using my time for other things – like looking for wholesale accounts. However, I’m increasing having difficulty getting orders to go through when my shipping and billing address is different – so there have been many times I’ve had to have orders shipped to me anyway. Not sure how others get around that – but I need to figure it out. Click the image below to enlarge.

The services that are used that show up in the subscription fees section are OAXray for help with online arbitrage, InventoryLab for listing and accounting, TaxJar for managing sales taxes, BQool for repricing, and JoeLister for selling products on eBay that are currently listed on Amazon.

I’ve also been selling a bit more via eBay through JoeLister – but I haven’t been that great about tracking profitability through that channel. We grossed $244 via eBay this month and I need to really look at that and see if I’m really making any money. And one final note – before I move on to the rest of our July Goals – storage fees. Long Term Storage fees will be assessed this month and Amazon is currently waiving removal fees. So this week that will be my primary focus – to recall stuff that isn’t selling and figure out what to do with it.

Goal 2 – July Spending Challenge ($8,000 spend at least 50% ROI & $400 Cash Back)

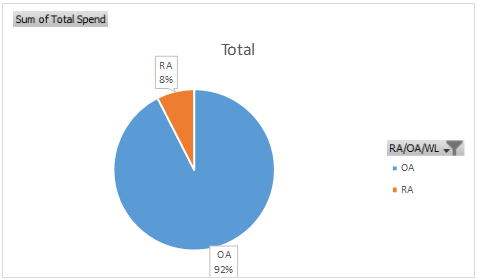

I was a tad short on this one as well. We spent $7678.50 on new inventory in July. I didn’t really track the ROI – but I know nothing was less than 35% – including cost for prepping. Most items were definitely above 50%. We did a little bit of retail arbitrage (RA) this month – but as you can see it was over 90% online arbitrage (OA).

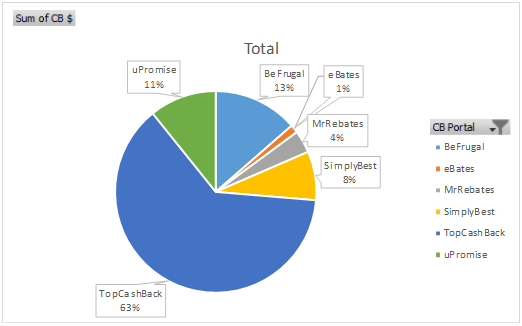

You can also see my main Cash Back portals as well. We made $440.97 via Cash Back portals and $51.57 in discounted gift cards. This does NOT include cash back or points/miles we earn via credit card purchases. We buy everything with credit cards and treat them like debit cards – tracking the expense when it occurs. I use a software called You Need a Budget (YNAB) to track my cash flow and budgeting which makes using credit cards this way a snap. It really helps make sure we don’t charge more than we can pay off each month.

Goal 3 – Refine daily, monthly processes and document my plan for building a team

This one I’m pretty proud of and it’s a work in progress. One of my main focus lately has been to really start building a team. I have thoroughly enjoyed learning the basics of RA/OA and I’m ready to move on. But before I can do that I need to have someone who can keep the basics going for me.

I started with the reimbursement process and I’ve documented how I want that done. We do the process once a month on the 15th – so this month I’m handing over my process to my husband and having him do all the reimbursements. If he can understand my instructions – then I’ll feel comfortable in passing it along to a VA.

I’ll admit this is probably one of the hardest thing for me – because I enjoy the nuts and bolts of it all. I also love learning new skills – but I have to admit I’m slow. I’m working on automating some of my tracking spreadsheets to sync with data that my prep center needs and I’m proud to say I decided to hire that out. I hired my first Fiverr gig and had someone create my spreadsheet for me for $5. I know I could have done it – matter of fact I’ve done stuff similar many times. But I had forgotten exactly how – and I could watch some videos and relearn – or I could send it to someone else and have it done in a day vs my few hours of trying to figure it out. I plan on doing a lot more of that. Well worth the $5 to me.

Goal 4 – Complete Inventory Sourcing Course

This didn’t get done. I’ve set aside all day Friday to complete this

Goal 5 – Close on our house, move everything else out and drive back to Colorado.

DONE!!! YEAH!!! We traveled back to Arkansas in early July and closed on our house Aug 5 and drove back to Colorado. We boxed up the rest of our stuff, and moved everything else to storage. And most importantly – we didn’t die in the 111 degree heat. Now that this is completely behind us – I really feel encouraged that I can dedicate the proper amount of time to this business and really make some progress.

So let’s look to August.

August Goals:

– Gross sales $7,000 with target Gross Profit Margin of 40%

– Spending Goal $8,000 with $400 Cash Back)

– Complete Inventory Sourcing Course

– Get ungated in the Health and Beauty category

See you next month!

~dana

Ryan’s last words: Thank you Dana for putting this post together and sharing this update on your business!

Sure – I use a combination of Amazon reports, Inventory Lab and my own spreadsheets. The majority of the data comes from Inventory Lab – including my FBA Gross Sales, COGS and Fees. I use budgeting software (YNAB) that tracks all my other expenses that I enter into InventoryLab. I enter all that data in my own spreadsheet to make the graphs – but all the data comes from IL. The chart of our average cost of sale is the only Amazon report I use. My spreadsheet also tracks purchases that we make and Cash Back sites that we use – which we manually update – so that’s how I could break down the Cash Back Portals.

Can you provide details as to how and where you are pulling this data and getting these summary reports? Are they in amazon? Inventory lab? Some other resource? And what specific steps to get the data? Thanks!

Nice post…Colorado should help with shipping large items to California, etc.

You may not need BQool any more, Amazon now has its own repricer.

Hey Ryan,

I’d recommend reading this post I did prior to relying on Amazon’s repricer completely: https://onlinesellingexperiment.com/amazon-automate-pricing-overview-and-pros-cons

Best Regards,

Ryan

What’s your plan on getting ungated in Health & Beauty?