The first month of 2015 is now behind us, and that means that it is time for me to share my financial results for January. If you missed any of my past financial results posts, you can find them HERE.

We’ll get started with how my time was spent during January. I took a couple of days off right after New Years, and also took 2 days off towards the middle of the month for a trip to Las Vegas with some friends from college. With the exception of those days, I spent the vast majority of my working hours specifically on my amazon business at an approximately 40 hour per week pace.

This month was a little unique as I spent a significant amount of time planning out the year and deciding where the biggest opportunities are for 2015. Also in January I hired two new team members who are initially going to be helping out with shipping. The hiring process was a fairly significant time investment as well, but the time investment should pay some significant dividends in the near future. Once the planning and hiring was completed it was back to “business as usual,” but this took awhile as the first FBA shipment of 2015 didn’t leave my warehouse until January 15th.

Before we get to the numbers, there is one more topic to discuss. My goal with sharing my financial results is to show what can be done, and is not meant to be seen as bragging or anything of the sort. I want to show that working hard and sticking with your plan can pay off. If the results turn out to be poor at any time I will share that too.

With that said, let’s get into the numbers for January. I want to provide as much clarity as possible into what I am doing on a month to month basis (if you have suggestions for additions to these posts, please let me know!). This month I will keep the same format that I used last month for the income statement directly from my InventoryLab account. The cash flow statement will be in the same format as in prior months. The numbers below will NOT be the exact numbers that go on my tax returns as there will be additional deductions not included here. It’s also possible that I missed a receipt or 2 and the spending numbers may be updated slightly, but all numbers from amazon/eBay are 100% accurate. Also for clarity, this does not include any income from any other sources, it is simply my income from amazon and eBay.

January 2015 Financial Results

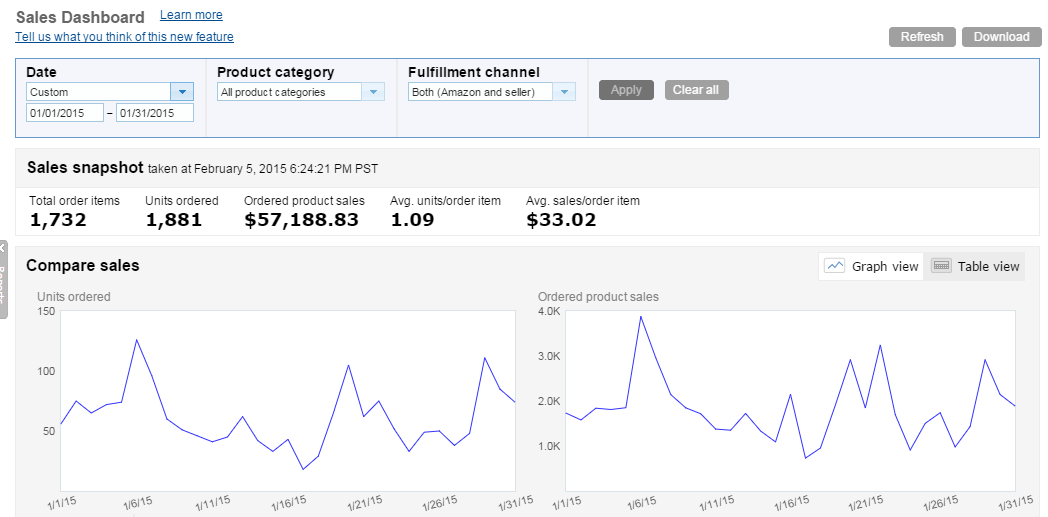

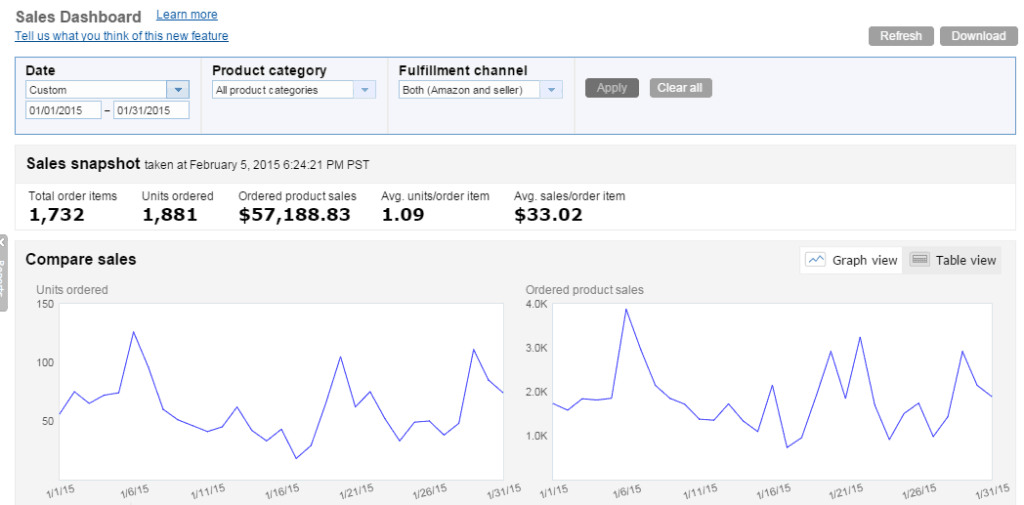

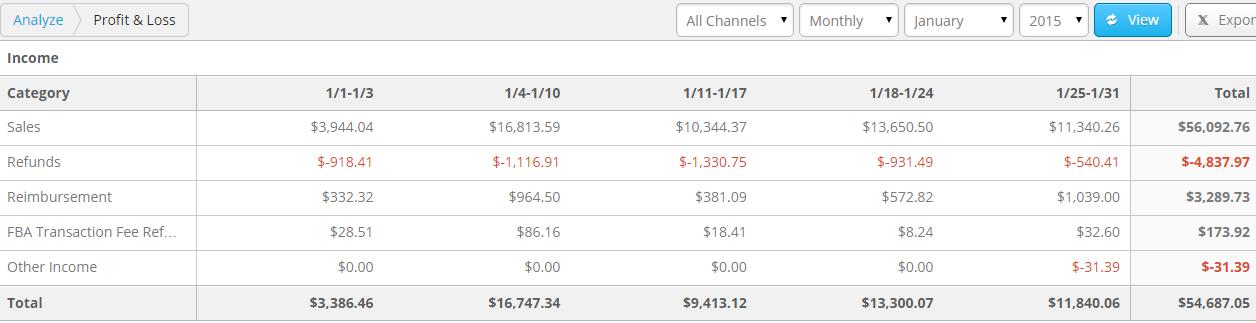

The first screenshot will be of the revenues. To get a better look, click on this image (or any others in the post) to enlarge.

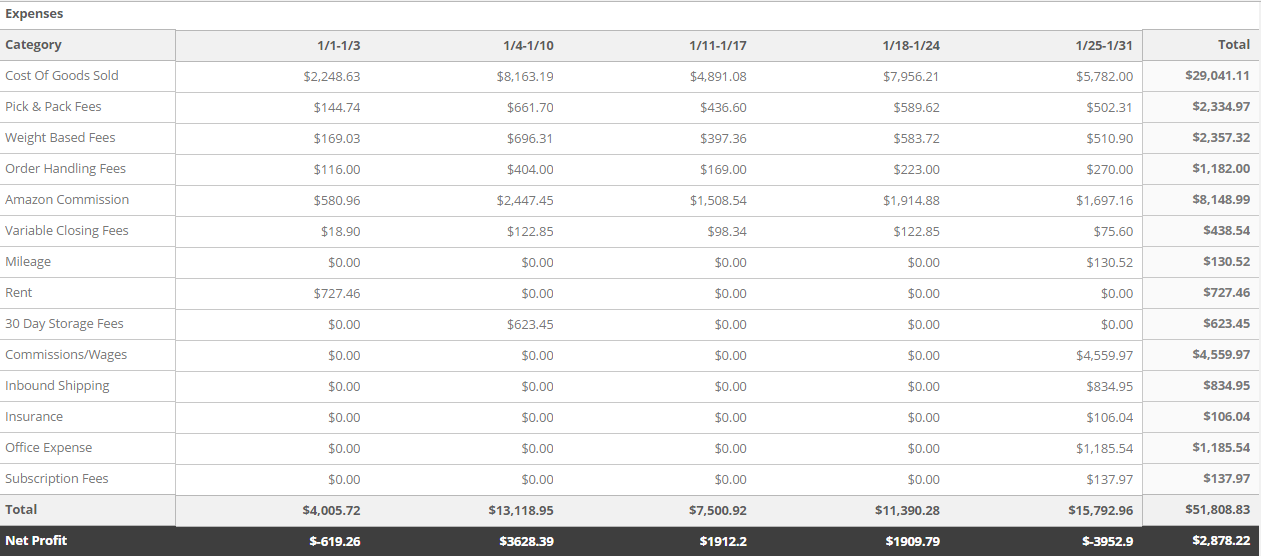

Now, in this second screenshots are the expenses for the month:

As stated previously, these screenshots are directly from my InventoryLab account which is the accounting system that I am using. A couple of notes are that certain items will only show up in one of the time periods even though they occurred over the course of the month, in these instances look at the total number for the month. Also the “other income” is the net effect of my eBay sales which I manually enter, which was a small loss again this month.

The profits for the month were quite low, especially in comparison to the approximately $55K in profit last month. There are several reasons for this. One of the biggest reasons for this was selling off items at a loss from Q4. There were 2 main reasons I ended up selling items at a loss, the first is attributable to not being as on top of repricing in December as I should have been, and the second is due to some poor purchasing decisions. In addition to selling off the losers, there was also a higher than usual return amount as just shy of $5K in refunds were issued to customers. This isn’t really that big of a deal considering I had around $225K in sales in December, but it does make the results for January look a little worse. Further still, profits were on the low side for the month due to how I chose to spend time this month. I made significant time investments the first half of the month that should pay dividends throughout the year. The profit number doesn’t tell the entire story though, as cash flow looks a bit better this month as you’ll see soon.

Here are the current services that I am using that make up the above numbers (note that some of these I paid for on an annual basis to obtain a discount):

InventoryLab – I use their service for listing all of my products for sale on amazon, as well as the majority of my accounting. I use their scanning app, Scoutify, as my main scanning app. Current cost is $49.99/month, you can sign up for a 30 day free trial with no credit card required.

Shoeboxed– This is a service that I use to manage my receipts. I send my receipts off to them in an envelope, they scan them into an online filling system, and mail them back to me. If you sign up through this link you can receive a 1 month free trial, and a 20% discount on your first 6 months if you become a paying user. Current cost for the plan I am using is $29.99/month.

Appeagle– This is the repricer I am using. It has been saving me significant amounts of time manually repricing. In addition, it reprices items up as well as down, so I have sold many items already for more than I have listed them for. They have a 14 day free trial, and if you enter coupon code “RYAN_G” you will receive 50% off your first month’s subscription if you elect to become a paying user. The current cost for this service is $50/mo.

Feedback Genius – This service automatically sends out emails when items are out for delivery to the customer, as well as 4 days after the item has been delivered. I tried out the free trial of this service, and it dramatically increased the percentage of orders on which I receive feedback without adding negative/neutral feedback, so I am now a paying customer.

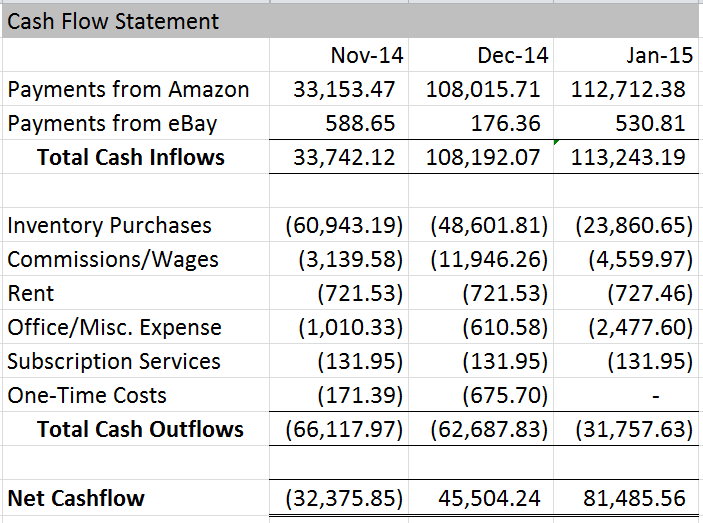

Now, let’s take a look at the cash flow for the month:

Cash flow for the month was very significantly positive. January was one of the rare months that I received 3 deposits from amazon, and was when I was paid for the biggest stretch of sales in December that I had. This is what I needed to happen as if you look at the cash flow from some of the prior results posts, it was significantly negative. A good portion of this $81K in cash flow was paid to the IRS in the form of estimated taxes for the year, as I cut a check for $38,000 in January for estimated taxes related to 2014. It still left me with a sizable amount of cash to invest for the coming year, but taxes did take a good chunk.

Now I will share some screenshots to provide some support for the above numbers I am sharing. Please note that the amazon sales number will not be exactly the same as what is shown above, as the screenshot below shows all orders that have been placed (but not necessarily shipped), while the above numbers are only for items that actually shipped during the month. Due to this the variance is to be expected:

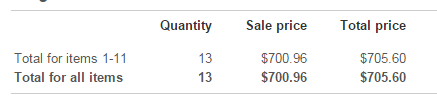

Now, for the eBay sales:

Overall, I am satisfied with how this month turned out. The positive nature of the cash flow will be very helpful going forward to continue to grow this business throughout 2015. I am confident the profits will begin to materialize and increase significantly in the coming months.

That’s all I have for today, if you have questions or comments please leave them below. If you enjoyed this post, please consider sharing using one of the buttons below!

Hi Ryan:

I found your blog researching the comparison between ScanPower and Profit Bandit and I find your detailed explanations in your blog very helpful. I am a fairly new Amazon seller also with some items on EBay, not yet into FBA and I am not currently using any of the listing and inventory tools that you mentioned. I certainly will do some free trials very soon.

Thanks, keep up the good work.

Hi Pam,

Thank you very much for the kind words, it’s great to hear you find it helpful!

Best Regards,

Ryan

Hey man this has some of the best info out. I was wondering? What was your total profit for the year 2014 if you don’t mind me asking. Also have you had good experience with wholesale/liquidation lots. Could you email me some sites that you would recommend I check out? Thanks

Thanks Jacob! Total profit for the year was about $130K. I will consider putting together a 2014 in review post in the very near future to tally it all up. I have had some pretty good experience with wholesale/liquidation lots. I won’t be able to email you some sites, but they are out there if you search for them.

Best Regards,

Ryan

Hey Ryan,

Just started following your awesome blog. Very useful information without a bunch of in your face advertising. Thank you!

I have an Inventory Lab book keeping question for you or any other readers (before I consult the wonderful tax folks):

Let’s say you bought 10 books for $10 from a thrift store but decided to only list 5 for sale at a cost of $1 a piece through Inventory Lab. How are you accounting for the $5 cost of the 5 unlisted books if you decide to never list them and end up junking or giving them away? (And you can’t return them to get your $5 back)

One solution would be to put $2 as the cost of each of the 5 listed books (which is what they essentially cost you) but I could see that being an issue if it’s a detailed receipt that you got from the thrift store or, if for whatever reason you decided to sell the 5 unlisted books in the future and not junk them.

If that question makes sense to anyone using Inventory Lab for their book keeping?

I’m trying not to use Quickbooks (which I am familiar with) because Inventory Lab seems to be good enough for the books of a small FBA business.

Thanks!

Derek

Hi Derek,

Great to hear you are enjoying the blog! In the instance you mentioned I would “write off” or expense the 5 books as unsellable. I would then just donate them to a thrift store or charity and they will provide you with a receipt you can use to deduct the amount.

Best Regards,

Ryan

Hey Ryan,

Fantastic post great to see you moving onwards and upwards. Your previous road trip gave me some great inspiration and I’ve now also expanded to UK Grocery as a result of your blog 🙂 How were your Amazon sales split between category for January? Keep up the great work!

Adam.

Thanks Adam! Here were my top 5 categories, my apologies for the poor formatting.

Product category / Ordered product sales / % of ordered product sales

Toys $22,116.69 38.71%

Books $9,494.94 16.62%

Grocery $3,699.98 6.48%

Health & Personal Care $3,485.80 6.10%

Office Products & Supplies $3,307.42 5.79%

Hey Ryan,

That’s great, thanks! I hope you’re proud of what you’ve achieved. It’s great to see you doing so well. Waiting in anticipation for your next post!

All the best, Adam 🙂

Hi Adam,

I live in the UK. Would be great to connect with you. If you need any advise or information on the UK market from someone who lives here, then please let me know I’d love to help out.

Hey Liam,

My apologies – I’ve just seen your comment. That would be great, you can find me on LinkedIn! Looking forward to connecting with you.

Adam

As always, thanks for sharing. Hard to believe that cash flow number of 80K this month! Time to invest in more inventory… 🙂

Thanks Stacy! I definitely will be buying a lot of inventory in the coming months 🙂

Best Regards,

Ryan

Thank you for your informative and honest entry Ryan. I just want to get your opinion on how and when to start paying to yourself an income? I’m currently dumping all of my profit back in the business and by doing that I paid all of my business overhead costs and any other expenses which is an awesome feeling because you don’t take any money out of your personal income. If I can get your guidance on this subject I will totally appreciate it. Thank you Ryan and keep the hardworking. You are a great inspiration to me. Have a great weekend.

Thank you for the kind words Yasar! I have just started taking a small salary in January. I would recommend holding off as long as possible as that will allow you to grow faster. So my recommendation is to hold off on the salary until you reach a level that consistently creates the amount of profit that you desire on a monthly basis, and if that’s not feasible then I would recommend holding off as long as possible.

Hope that helps!

Best Regards,

Ryan

Hi Ryan

Thanks for the honesty of your newsletter, its refreshing.

I’m not a big seller but have had some pretty good luck at sourcing certain items for almost nothing via info from Peter Valley, a lot of hard work, a little skill and a great deal of luck. I live in a great area for sourcing.

I am slowly building up my inventory but am concerned about FBA storage fees as I have many long-tail items. Have about 550 in FBA and adding 100-200 a month at this point, With about another 150 items that I dont trust to be handled by FBA.

I thought a repricing tool could be helpful but I am leery since I have many textbooks and about 30 law books worth $100-$350 with very good ranking and don”t want to lose potential profit because someone with thousands of books is selling the same item at ridiculously low prices merchant fulfilled.

So thank you for putting your mistakes as well as your successes out there. I get a lot of actionable information and motivation from them.

I’m very interested in your thoughts.

I appreciate for your time!

Hi Melissa,

Glad to hear you are enjoying the content. As far as a repricer, you can exclude any items you want from repricing, so you could exclude the more valuable books from being repriced if you wanted.

Also, on any items that you do reprice, you set a minimum price that you will accept and your repricer won’t go below that price. Hope that helps and let me know if you have further questions on repricers.

Best Regards,

Ryan

Very interesting post, thanks for sharing.

Glad you enjoyed it Nick!