Updates from November 2018:

These financial results posts cover my first month selling online full time through June 2015, a month that saw my account briefly suspended and a record amount of profit for my business at the time outside of Q4 – $23,904.41!

If you are planning on selling on Amazon, you’ll find a lot of great information through these posts and the hundreds of others that I’ve posted on this site since then. If you want an easy way to get started fast on Amazon, you should definitely check out our Arbitrage Accelerator Challenge!

Original Post:

January is in the books, and that means that it is time for another financial results post. January was my 4th month selling online full time, and I was very interested to see how sales in January would be after having a very large sales jump in December. If you missed December’s results post, you can find it HERE.

First, we’ll get started with a little background on how my time was spent this month before we get into the numbers. I took 2 days off in January, and would say I averaged 30-35 hours per week directly related to online selling activities. I spent some time meeting with accountants to get a plan in place for taxes this year, and in the future. I also met with a lawyer regarding business structure, and a few other questions I had for the future as I begin to scale my business. These items cut into my revenue generating time, but having these meetings should help to ensure I have things properly set up for the future. I will post about some of these items, including the business structure I will be using, in a future post. For January I worked the majority of the month on online selling, but there were some lasting effects on sales from not working much the last half of December as was discussed in the December results post. The lack of inventory at the end of December definitely contributed to lower sales in January.

Before we get to the numbers, one more topic to discuss. My goal with sharing my financial results is to prove that this can be done, and is not meant to be seen as bragging or anything of that sort. I just want to show that working hard and smart, and sticking with your plan can pay off. If the results turn out to be poor in future months, I will share that too.

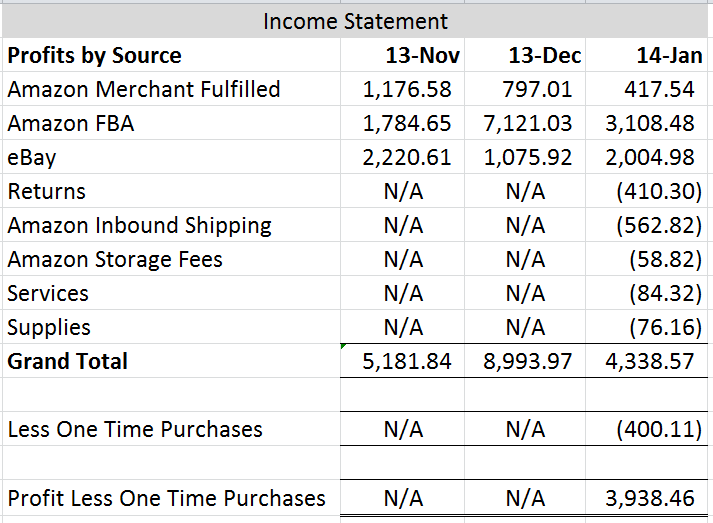

With that said, let’s get into the numbers. I will be sharing a fair amount more detail in this months post compared to previous months. I want to provide as much clarity as possible into what I am doing on a month to month basis, and will continue to add some more details as the months go on. The numbers below are basically the profits that I am making for the month. The profits are calculated only on items that have been sold and shipped during the month. They were calculated by taking selling prices, minus all fees, minus all shipping and packaging costs, and subtracting the cost of the items. This month, I have broken out the cost of inbound shipping to amazon, customer returns, supplies, storage fees, and services. The FBA profits number factors in reimbursements from amazon for items lost or damaged at the warehouse. This will NOT be the exact number that goes on my tax returns as there will be additional deductions for mileage, cell phone, home office, etc. I will be adding some of these additional expenses to the results posts in the coming months. However, these are costs I would generally be incurring anyway, so for simplicity, I will be leaving them out of the calculations. Also for clarity, this does not include any income from www.textbooks4you.com, it is simply my income from amazon and eBay.

January 2014 Financial Results

Hopefully, these numbers give a clearer picture of where my profits are coming from. You will see that I also had $400.11 in one time purchases. These were investments in my business, one is a bluetooth scanner, and the other is a label printer. Both are tools that have already begun to increase my efficiency, and should pay significant dividends in the form of time savings for the foreseeable future. I will be doing a post about these tools later in the month to show how they will be helping to save me time. I added a separate line item for these costs, as they are one time costs, and will not need to replaced for several years.

These numbers are quite a bit lower than I saw in December, but I believe that this is due partly to not continuing to send in inventory to amazon at the end of December. I anticipate a fairly significant increase in profits for February, especially as a result of the inventory that I have been buying throughout January.

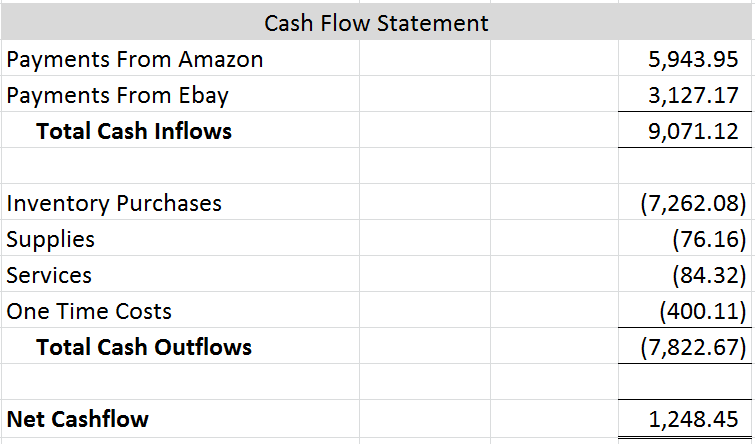

Also new this month, I have added in a simple cash flow statement. This will show all of the cash inflows that I have during the month, as well as outflows. Take a look here:

January 2014 Cash Flow StatementOne item to note here is that inbound shipping costs and refunds to customers are directly taken out of my amazon account, and are factored into payments from amazon in the cash inflows section, and as a result do not need to be added into the cash outflows section. I have added this as a means of gaining some clarity into how much spending goes into making the profits that I do. Basically what this means is that my bank account balance is $1,248.45 greater than it was at the beginning of the month. This number is significantly less than the profits I realized during the month, and this is due almost entirely due to inventory purchases, as I purchased over $7K of new inventory in January. My current plan is to reinvest virtually all profits into the business buying as much inventory as possible, and thus net cash flow will be significantly lower than profits for the foreseeable future as I grow my business.

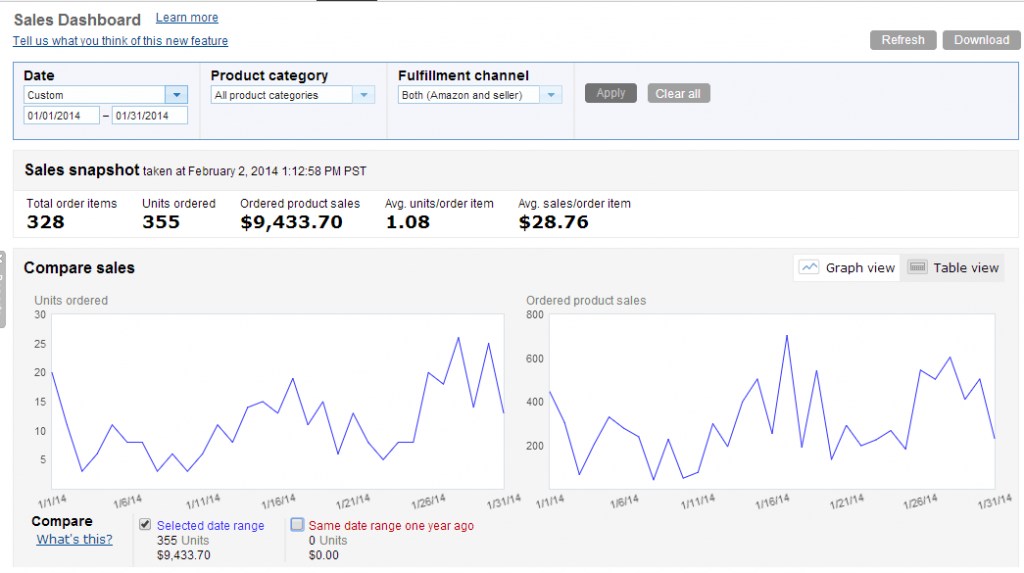

Now, here are some screenshots from my amazon and ebay accounts to provide some documentation for the profit numbers. Here’s a screenshot of my amazon sales for January (click to enlarge, same goes for all screenshots in this post):

As you can see I had a little over $9K in sales for the month on amazon, but you can also see that the bulk of my better sales days came towards the end of the month. Next up is a screenshot of my amazon sales by category:

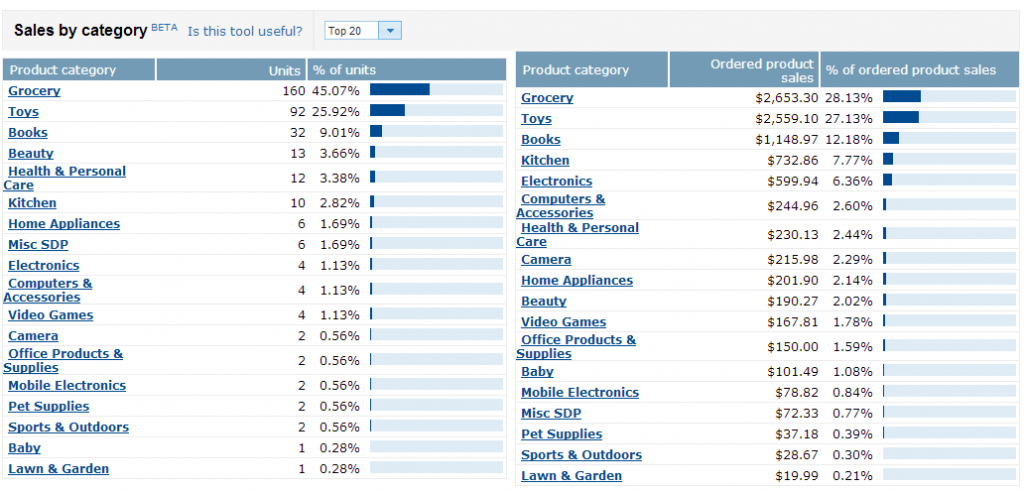

Grocery and toys continued to be my top 2 categories for the month for both number of orders, and sales volume. These will continue to be 2 of my top categories, but I plan on working to add some more sales to the Beauty, Health & Personal Care, and Pet Supplies categories in the coming months. I want to focus more on these categories to build consistent sales year round, as toys in particular will see a large spike in December and then may trail off the rest of the year. I don’t plan to avoid the toys category by any means, I just want to have a diversified product offering.

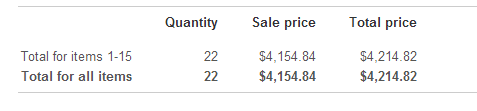

The last screenshot for today is January’s ebay sales:

I have yet to find a better report to show eBay sales by month, but will see if I can find one for next month. The items I sold on eBay this past month were quite valuable, with an average sales price of almost $189 per item. Lately with eBay I have been focusing on higher dollar items as there is more time involved with listing and shipping the items. This average sales price is quite a bit higher than it will likely stay, as I sold 9 of a single item for $295 each.

Overall, for January total sales between amazon and eBay were $13,588.54. I am happy with these results for January, but definitely am looking to increase in the coming months as I set a big goal for the year. If you missed that post, you can find it HERE.

That’s all I have for now, if you have any questions or comments PLEASE leave one below.

Hi Ryan,

Really great blog. I’m interested to learn more about the thought process behind “reinvest virtually all profits into the business buying as much inventory as possible.” I’m a beginner and I think I get the gist of the idea, but I was wondering if you could elaborate on it or suggest any background materials I could read to better understand the business analysis/concepts for such a move. I guess I’m trying to learn how to plan and forecast for the AZ FBA business model. Thanks.

Hi Corbin,

Thank you. I don’t have any real background material, but really the only logic behind it is the more cash I use to buy inventory, the more I will sell, and then the more I sell, the more I profit. Ultimately reinvesting just expedites the timeline of all of this. If you look through my financial results posts in order, and particularly the more recent ones, you should be able to see the result of my strategy.

Hope that helps.

Best Regards,

Ryan

Hi Ryan,

I love your blog, thanks for being so open, you inspired me to start my own blog!

Anyway I was curious what your starting investment was.

Glad to hear it Mark! I started with about $5,000 of cash ready when I went full time, but I didn’t start from zero since I have been selling online part time for years.

Best Regards,

Ryan

Hey Ryan,

JLD is amazing, it is simply spectacular what he has done in his short time. The real leaders these days are being very transparent with their business, something you are doing great with. You have to make a product, I am sure people will buy.

Now I had some questions.

What services do you use that make up your almost $85? Is it on a monthly basis? I am sure I will find this out with the next income statement probably but I am not that far into your blog yet. haha

Now I am not sure I really know how to read your numbers. Ok here is what I get… you had a little over $9k in sales. Your profits state that they are about $3.5k. Your Amazon payments are almost $6k. Now if I were to add Your Profits from both Amazon sides + your returns + inbound shipping + storage fees = Around $4.5k, where is this other $1.5k?

Now I realize that Amazon takes almost a 1/3 of the sales right off the bat, So the other $3k is there to equal the $9k. But I just can’t figure where this other money is calculated at.

Now don’t get take that question as I am calling you a liar, I am very VERY new to all of this and I probably just don’t see it right in front of me.

Keep up the great work!

Hey Jim,

You are making good time through the blog, haha. Glad you are going through it all, and thanks for leaving comments! The $85 per month is Scanpower, InventoryLab, and a weekly UPS Pickup. You will likely be reading more about these services soon.

As for your question on the numbers the other $1500 would be the amazon commissions and FBA per order fees. I don’t break them out separately, but looking at it now, I may in future results posts to make these posts easier to understand exactly how I go from my sales number to my profit number. Let me know if this makes sense.

Best Regards,

Ryan

Pingback: February 2014 Results from Selling on Amazon and eBay

Pingback: Sharing my Story on Jessica Larrew’s blog

Hey Ryan, came across you/your website through the mysilentteam FB group. Good content here. I just started in December with FBA and am at the opposite of your life situation when you started. I’m married with kids and looking to use FBA as one stream of a multiple income stream approach to income. Love what you are doing with the blog and was what I was thinking of doing because it is so helpful to see what people are learning along the way. Definitely good to learn from the experts who have “been there and done that” but to see someone in the trenches making mistakes and growing is invaluable. Thanks also for sharing your real numbers. I’ve been inspired by the likes of John Lee Dumas and Pat Flynn who take a reveal all type of approach. Keep up the good work.

doug

Hey Doug,

Thank you for the kind words about the blog, I appreciate it! You are in quite the opposite life situation compared to me, but I still think FBA can be a great additional income stream for someone in your situation as I am guessing you will find out. I have also been inspired (and somewhat amazed) by the numbers on Pat Flynn’s blog, I hadn’t heard of John Lee Dumas before your comment so I will have to look him up.

Best Regards,

Ryan

Hey Ryan,

Like Dimitri you have a fan with me too. Great content, keep it up man. Looking forward to Feb.

Best,

Leo (from Gmargin)

Hey Leo,

Thank you! I have been checking out your blog the past couple of days, and you have a lot of great content there. The stack challenges are a great idea, and your goal of teaching 10,000 people how to make 10k is awesome.

Best Regards,

Ryan

I got to your blog from facebook group Amazon Sellers. I’ve bee n selling for a few months now. I have not tried selling groceries yet

I also am interested in where your get deals on groceries.

Thanks

Hello George,

I am getting my groceries at a large variety of stores. This post I did a few weeks back should give you some more information on what I am doing with groceries and where I am buying them: https://onlinesellingexperiment.com/selling-groceries-on-amazon-fba-a-few-tips-to-get-started/

Best Regards,

Ryan

Great post! What are your favorite retail arbitrage stores? I live in Western North Carolina so I don’t think I would be any competition for you.

Do you use any sort of software to help speed up your listing process on eBay?

Thanks for sharing your progress.

Thanks Larry!

My favorite stores currently in no particular order are: Kmart, Target, Shopko, Big Lots, and Toys R Us. They have been my main 5 lately and some of these are probably in your area as well.

Currently on eBay I do not use any listing software or anything besides ebay.com or ebay mobile. I may look into trying one out in the future as the listing process on eBay is currently a “pain point” so to speak. Hope these answers help, and let me know if you have further questions.

-Ryan

Hi Ryan, awesome post. I come from an accounting background as well and I love seeing your raw numbers. I think it is something that is lacking on most of the many FBA/eBay blogs out there, and it is very motivating. Keep it up!

Thanks Nick, glad to hear you like it! My goal is to share more and more details as I go along so stay tuned.

Best Regards,

Ryan

Hey thanks for the great posts

what are your ratings looking like on amazon?

alot of people from what ive been reading say they struggle to get people to leave ratings for there sales.

im wondering how to get people to eave some feedback

thank you

Thanks for the kind words Tim! Currently I have 100% positive feedback on amazon with 40 customer reviews. This is on a little over 2,000 transactions so the percentage of the time that I receive feedback is very low.

I don’t take any actions (sending emails, using a service, etc.) to try to boost the number of feedbacks I receive from buyers, but if I get a negative or a neutral feedback I will try to resolve that right away. My current take is that if I provide good service, and proactively resolve any problems with orders that customers I have, my feedback score will take care of itself.

The low percentage of orders receiving feedback can be frustrating, but I have not found a method that is time effective to receive a significantly higher number of customer feedbacks. I may dedicate a post to this in the near future to provide some further insight and what I do if I receive a negative feedback, hope this answer helps!

Best Regards,

Ryan

PS. I love your No Alarm Clock experiment. That is my philosophy–if you are tired, sleep until you are fully rested. If you are awake, work hard until you are tired. Naps are fine, too.

Thanks for the comments! Everyone will have different goals from online selling, and that’s great that you are able to pay an extra 1-2K per month towards the mortgage. I am looking forward to see how the no alarm clock experiment turns out! If you ever have any questions on anything in the blog that I can explain further just let me know.

Best Regards,

Ryan

I am afraid that selling big time on Amazon is way over my head. My brain glazes over just trying to read all of the details in your wonderful charts. I think I like selling on Ebay because I can Keep It Simple. I don’t even try to keep track of what each item cost. I have one checking account, one credit card for my Ebay business. I use Outlook, or Go Daddy app from Ebay to tell me how much profit I am making. OR I just look at my checking account balance. Is it going up, or down? If it is going down I need to sell more and buy less. My whole objective, as a homemaker and seller, is to pay off our mortgage quickly. I manage to send an additional 1-2K per month towards that. That is fun to me! But do keep up your great work. Maybe I will catch on as we go along? 🙂

Hey! Nice website! I’ve seen you around on reddit before and noticed that the content you post is always high quality and very informational.

I’m guessing you source mostly from retail? Do you have any tips for that, because I’ve been trying to get enough inventory to warrant getting into FBA.

I also noticed there are a couple of us that have these “selling experiments” going on in 2014, hahaha. You, me (I’m over at http://www.exponentialslack.com) and LeoARPG (sp?) over at blog.gmargin.com. This is great! I love seeing the progress of others, it’s really motivational.

I subscribed to your site and will be looking forward to future updates!

Thank you for the kind words! I just checked out your blog and LeoAPGs as well, very cool. I will definitely be reading some more on both of them in the near future.

For your question, retail is currently my primary source. I still do a little bit of thrifting, but I would say 95% of my time is spent on buying retail items to flip. My main tips when getting started with retail are to go to as many stores as possible to get a feel for which stores have the best deals in your area, and then to find the clearance sections at those stores first. Clearance items are a large part of what I purchase lately, and is generally my first stop at any store I go to as they provide the highest margins. I wouldn’t avoid retail priced and sale priced items, but they are more work to find that are good for resale. Hope that helps!

Best Regards,

Ryan

Re ebay & Cassini; have you noticed any correlation between the No of watchers and an increase in sales?

Hi Karl,

Currently I have not noticed any major changes. I have temporarily put eBay on the back burner to focus more on selling via FBA at this point, so I haven’t been monitoring my eBay stats very closely lately.

Best Regards,

Ryan