In this post I will be talking about something that I wasn’t doing correctly for much of 2015. That something is properly accounting for customer returns. What I was doing wrong was not properly accounting for the buy cost on customer returns that were sellable, an easy mistake for any of you who are starting to sell on Amazon. Essentially when I was doing my accounting, I was double counting the buy cost of items that were customer returns that were sent back to Amazon warehouses in new condition. I’ve documented some mistakes I’ve made along the way before in older posts, for example in Q4 of 2014 and May through July of 2014. This one was a bit larger magnitude though as it affected my overall accounting, and took quite awhile to fix. In today’s post I am going to go through the correct process for accounting for returns so you can hopefully avoid some of the trouble I created for myself.

Before I dive into the examples and explanations, I have to give the disclaimer that I am not a CPA. This is not to be considered tax or any type of professional advice. Also, the discussion in today’s post is based on using the accrual basis of accounting.

How to Account for Customer Returns

The proper way to account for customer returns is to reduce your income the full amount of the return only when the item is defective, or if the item is not sellable. If the item is in new condition, and remains in sellable condition, then it is necessary to effectively put the item back into your inventory at its original cost.

Let’s run through 2 quick examples to show you what I mean. The variables for both scenarios will be a selling price of $50 and a buy cost of $15, and the customer returns the item and gets a $50 refund.

Example #1: The customer returns the item in defective or damaged condition. Basically it’s in a condition that does not allow you to sell the item again. In this case, the full amount of the return ($50) would be a reduction of income and deducted from your overall profit. There would be no need to do anything extra to account for the buy cost. The net decrease to your overall profit would be $50.

Example #2: The customer returns the item in brand new condition, and you are able to sell it again as new. In this case you would need to effectively put the item back into your inventory at its original cost. In this case you would have a reduction of income of $35. The $50 return less the $15 to put the item back into your inventory at its original value. The net decease to your overall profit would be $35.

From the above examples you can see that example #1 has a much larger impact on net profit, and makes it appear much lower.

This is why it is essential to go through and account for the buy cost portion of transactions when your items remain in sellable condition. If you do not go through and do this your net income will be understated. Going through and doing this process will actually show an increase to your net income. If you haven’t been going through and accounting for items that are sellable, your business might be more profitable than you thought. This also happens to mean you might have more taxes to pay.

Now that we know how we are supposed to account for returns, let’s get into the details of determining the status of your returns. Here is the process to find the status of any return in your account:

- Login to your seller account.

- Hover over reports and select fulfillment.

- On the left hand side of the screen under Customer Concessions, select “Returns”

- Paste in the order ID that you want to check the status of

- Select the proper event date, I generally use the last 365 days

- Then look through the results to see the status. Below are the 3 most common instances you will see and how I handle all 3.

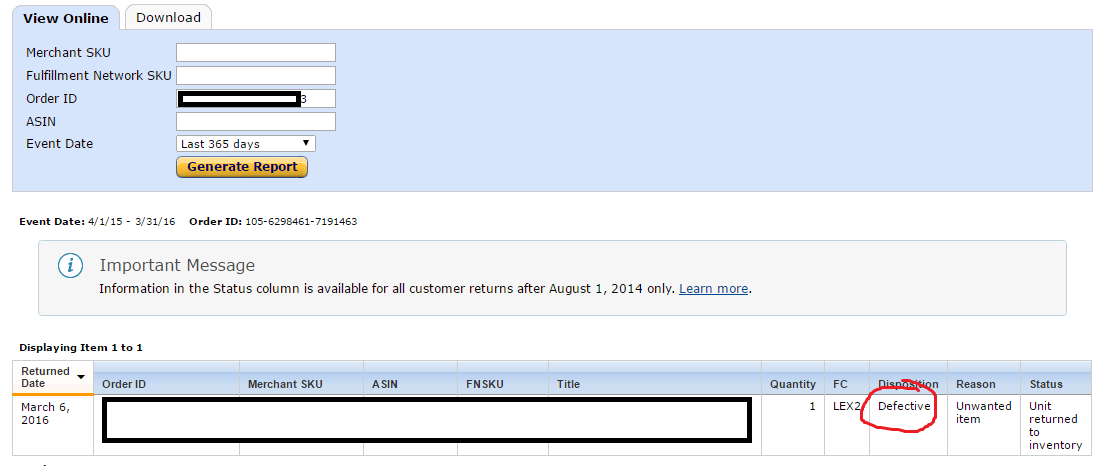

First, here is what it will look like if your item is defective (click to enlarge, same goes for all screenshots in this post):

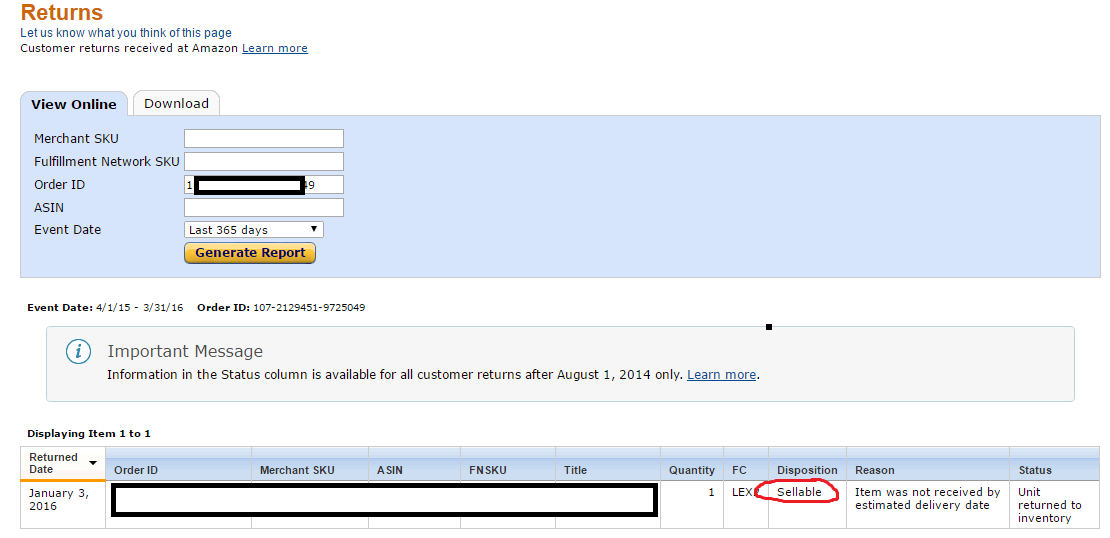

Next, we have an item that is sellable:

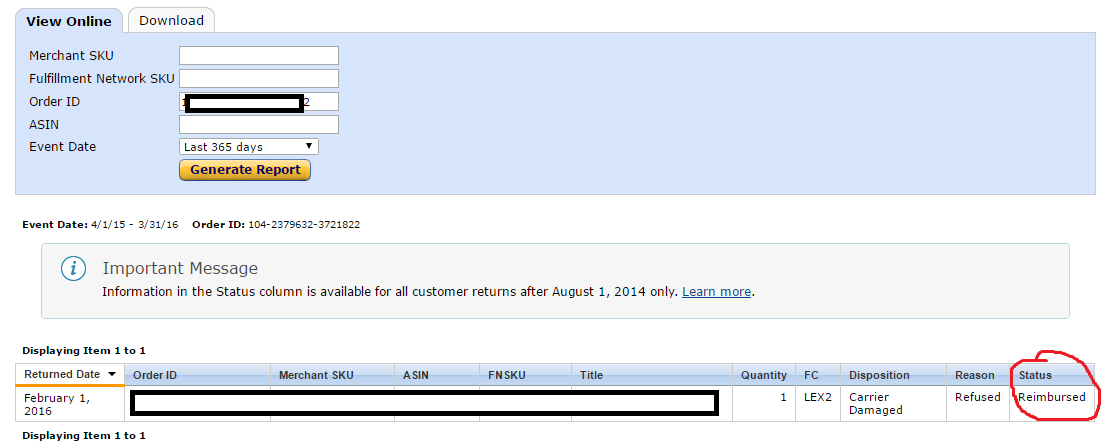

The third thing you will see is a status of reimbursed:

Now, I will show you how I account for this using InventoryLab. Here’s my process:

- Login to InventoryLab

- Click Accounting at the top of the screen and select “refunds”

- Select the date range that I need to go through

- Go through each order ID that needs to be marked as sellable or defective by using the steps outlined above to determine the dispostion of each order ID.

- Mark as sellable / defective based on the disposition of the item

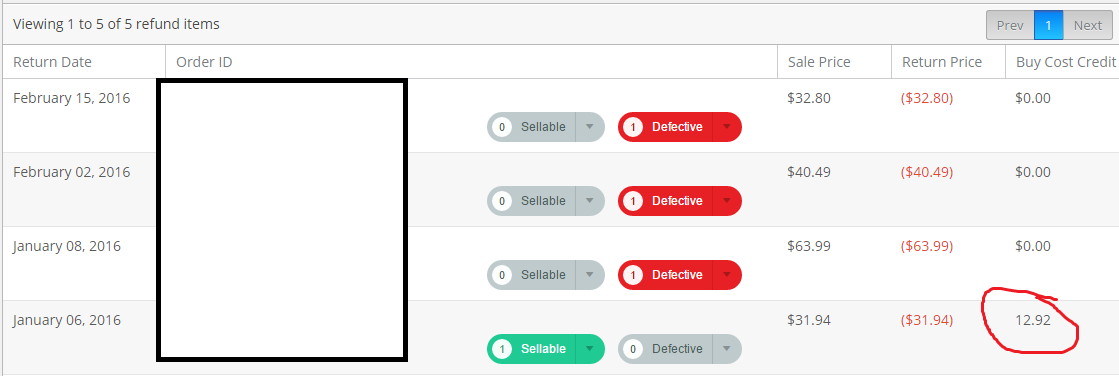

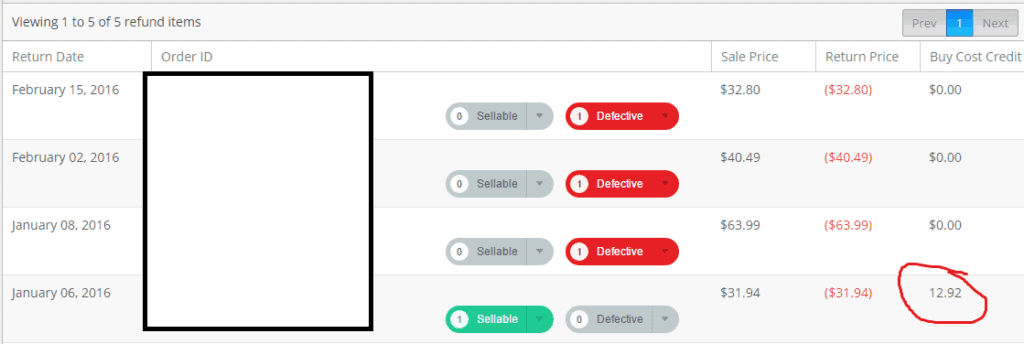

Here’s an example of what it looks like:

When using InvnetoryLab all I have to do to make sure my returns are properly accounted for is to go through and copy the order IDs from the refunds report, check the status in Amazon, and then mark as sellable if needed.

There’s no reason that you have to use InventoryLab to do this process. If you don’t use it, all you need to do is track the buy cost of returns that are in sellable condition using whatever system you are using.

Hopefully this post helps to provide a little bit of clarity for how to account for customer returns when selling via Fulfillment by Amazon. If you have any questions or comments, please let me know below!

Oh never mind. I just figured it out I think. Items that were sent back to my house are the ones that I listed as defective.

What if it has “customer damaged” under the disposition? (as well has item being returned to inventory).

Hi Phong,

For items that are customer damaged, I mark those as defective in InventoryLab too.

Best Regards,

Ryan

Ryan,

Just what I needed to read. Have been using IL for a few months now and the returns/reimbursements are coming in, some sellable some not. Was putting off figuring out how to do this in IL properly. I ordered your reimbursements PDF as well which is outstanding. Thanks again.

Kent

Hi Kent,

Great to hear this post was helpful, and that the reimbursements book was helpful!

Best Regards,

Ryan