Today I’m excited to share the beginning of a new series of guest posts with you. If you’ve been a reader here for awhile, you know that I discontinued share my financial results publicly each month. Over the past month I did a post in the Online Selling Experiment facebook group looking to see if there were individuals who would be interested in sharing their FBA journey via guest posts on my site for 6 months or more. There were 2 individuals that I selected from those that are willing. Today will be the first post from Dana. Dana started with FBA less than 6 months ago, and shares in great detail how her business has gone so far. We will be hearing from Dana on a monthly basis going forward.

Take it away Dana:

Hey guys – my name is Dana and I’m beyond thrilled to be guest blogging for Ryan. If you’ve followed Ryan’s blog for awhile – you know he use to post his monthly financial reports for his FBA business. For various reasons, he decided to no longer post those publicly, but recently reached out to see if anyone would like to resume and start posting their results. I figured – why not! What better way to keep myself accountable.

First, a little background about me. My husband and I started FBA in January after looking for a while for opportunities to make money online. By March, it seemed like FBA was a legitimate way to replace my current job and on March 21, I put in my notice at work. I’m an IT Consultant and Project Manager by profession and have spent the past 25 years in Wireless Communications. But slowly over the years my job had morphed from a job I loved to a job I loathed. I knew it was time to make a change. In future post I’ll share a little bit more about my ‘why’ and my long-term goals for this. But for now – let’s just dive into the numbers.

I’ll be somewhat following the same format Ryan did – and we’ll be reviewing my monthly gross sales, expenses and net profit. I’m no MBA and to be honest I have a bit of a learning curve when it comes to the business side of all this – but I’m gonna give it my best shot. As we go along, I plan to share my complete P/L, Balance Sheet and Cash Flow statements. And I’ll be honest – it won’t always be pretty, but I will be sharing both the good and the bad.

April 2016 Financial Results

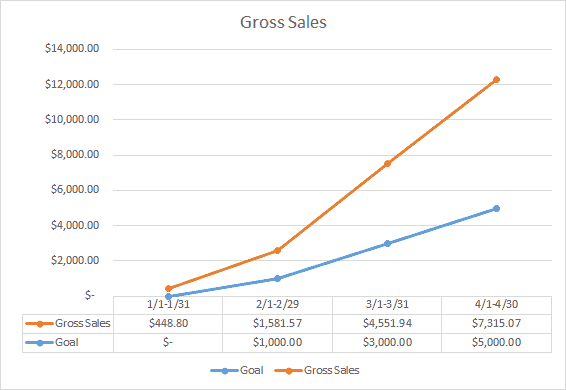

So here we go. I opened my FBA Seller’s account mid-Dec of 2015, bought a couple of products I saw on an after Christmas sale, sent them into Amazon and the left on a cruise. Nothing sold until Jan – so we’re going to start there. Below you can see my Gross Sales to Date. The Orange line represent Gross Sales and the Blue line is our monthly goal. As you can see – to date we’ve exceed our sales goal – so I’m pretty happy about that. This is strictly FBA – as I haven’t really jumped into eBay as of yet. I did have about $80 in eBay sales that isn’t reflected here – but that was just crap I had laying around the house that I sold. All-in-all – I’m happy with the direction the orange line is going. (Click on any image in the post for a better view)

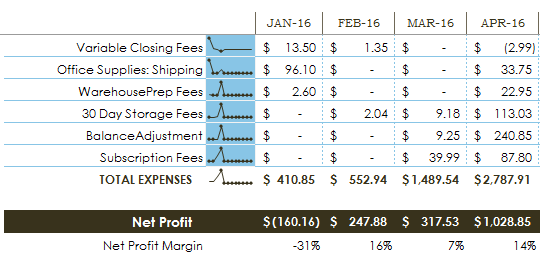

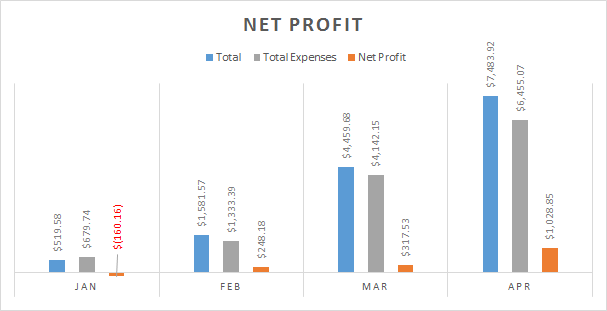

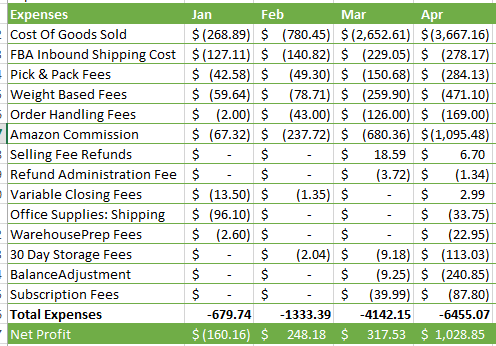

But as we all know Gross Sales doesn’t tell the whole story. Sure, they are fun to look at, but until we take into account our COGS and other expenses it’s not really an accurate reflection of money in our pocket. The chart below gets us a bit closer to the truth. The blue bar represents the total Gross Sales (after reimbursements, returns and eBay), the grey bar represents our Expenses (FBA fees, COGS and monthly subscriptions) and the orange bar is our Net Profit (Gross Sales – Expenses). What this doesn’t show is additional expenses I had as a business such as training, some additional software and my packing supplies. I’m still working to get all that data into Quickbooks. I use QB online to track all my expenses because – while I love InventoryLab – it’s not a true accounting software tool. But you can see the chart on the right has a breakdown of the expenses included. Don’t ask me what most of these are – they are pretty much all Amazon fees – which they apparently love. All of these fees come from InventoryLab – which I use to track Cost of Goods and help identify my most profitable items. I do love InventoryLab for making that easy!

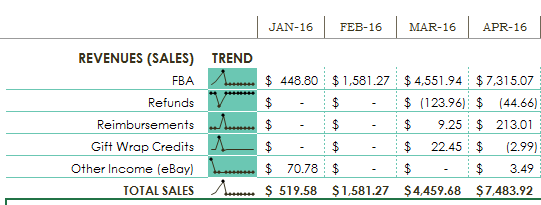

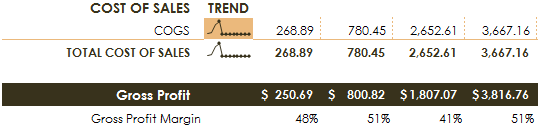

For those that like even more numbers – here is a quick summary of total Gross Profits and Net Income to date.. This shows a bit more detail in terms of trends and includes the Gross Profit Margin and Net Profit Margin. You can see while our sales revenue increased dramatically in March with a nearly 300% increase from Feb, we were working to move out some of our ‘bad’ choice inventory from when we started, so our Net Profit Margin decreased significantly. But that’s ok, because we were able to take that cash and roll it into better inventory. Because when you know better, you do better 🙂

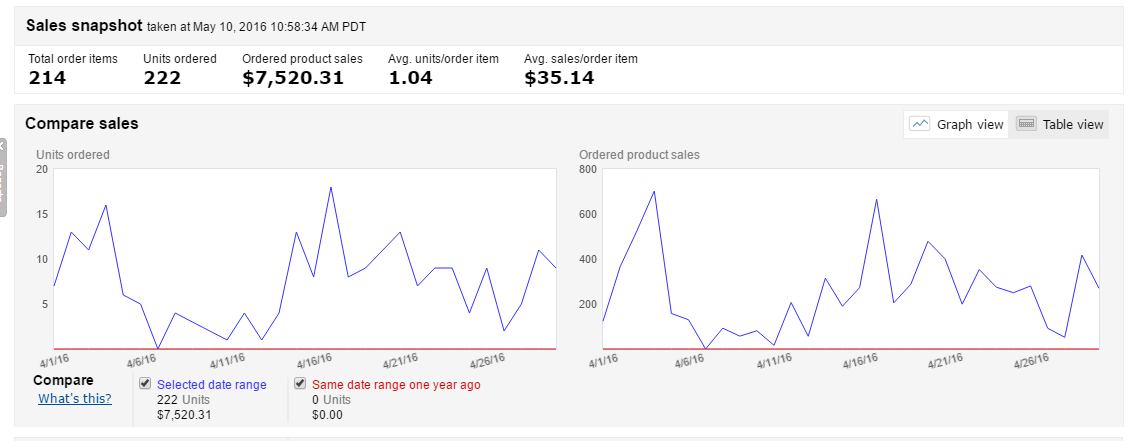

Below are our results for the month of April. This comes from Amazon Seller Central. A couple of notes about this…notice the average sales price per order. I think this is important because I see a lot of people ask opinions on if they should buy something – and many times it’s a lower priced item. While that can sometimes work – selling lower priced items requires much higher volume. So IMO, when you’re starting out – you want to aim for a higher sale price with decent ROI – that helps get the snowball rolling faster. At some point I might consider lower priced items – but only if I can get them at a very low cost and high volume. Otherwise I’m just spinning my wheels.

In general, what we’ve sold here is from buying wide – meaning we probably didn’t go more than 10 items on a single SKU – maybe 15. There is probably 1-2 replenishment items in here – as I’m still struggling to find the jackpot on those. Other than the items we found just around our house as we were cleaning out. All of this is 100% OA – done by my husband. While we used a few lists early on – we used no lists in the month of April. We actually found that our finds were just as good or better than what was on the list. Yes – it takes time – but so does anything worthwhile. We use OAXray – but haven’t hired a VA as of yet. I’m ungated in everything EXCEPT the big ones – grocery, health and beauty and of course DVDs. I’m working on getting ungated in Grocery and Health and Beauty and hope to have that going in the next month. I’m also have 2 wholesale accounts open and I’m starting to research their products.

So that’s pretty much it. Our goal for May is to try and hit $8,000 in Gross Sales and so far we’re on track to do that. But inventory seems to be moving faster than I expected and we’re also in the process of moving from Arkansas to Colorado, so I’m concerned that we’re going to be able to devote the amount of time necessary this month. We’ve just signed up Prime Zero Prep as our prep center and we’ve started researching a few wholesalers. We have tons of work to do to get our house ready to be put on the market and we’re moving over Memorial Weekend – so we’ll see how that impacts the numbers next month. I’ll also work to ensure a more complete picture of all our expenses are included. Here is a list of our goals for May:

May Goals:

– Gross Sales of $8,000

– Start using a prep center

– Get ungated in Grocery

– MOVE – which honestly will be taking the majority of our time.

So, let me hear from you guys. Any questions, suggestions or comments are welcome. Also let me know if you see something not right with the numbers – I’m not ruling out math errors! Meanwhile – I’m going to pack a few boxes.

Later!

~dana

Great post

Pingback: How much can you earn with Amazon FBA? (Income Reports) - RevFBA.com

Pingback: May 2016 Guest Financial Results Post From Selling on Amazon – Dana – Online Selling Experiment

Dana – Thanks so much for sharing! What you’ve accomplished in a short number of months is impressive and it’s captured here with a lot of clarity. No doubt, sharing your results on an ongoing basis will be a reflective process that will catapult you forward. I think you’ll find using a prep service a breath of fresh air, though it will eat into your profit a bit.

I’m curious to know what strategies you are using to identify wholesalers? Are you looking searching for wholesalers in a variety of categories and niches or focusing your FBA shop in a more targeted/specific area? Have you received any resistance from wholesalers yet?

Hi Joseph – I’m already loving the prep center. The sheer volume of boxes in my house with receiving, shipping out and moving was becoming overwhelming.

My strategies for finding wholesalers? Well, I’m still working on that. I have a wholesale account with one niche supplier that I’ve had for awhile. I opened it with the intent of starting an online business but never followed through. I am now taking another look at their products and identifying items that look Amazon worthy. It’s in a gated category – which I’m not ungated in – which is definitely on my to-do list.

For now, my FBA shop is pretty much anything I think I can make a profit on. I have several niche ideas – but right now they reside only in my head and on paper. It’s one reason I’ve struggled finding wholesalers to date. I can’t decide where to start. So – like everything else – I’m just gonna have to start. I honestly haven’t spent a whole lot of time on looking lately.

I have two wholesale accounts currently that are in two totally difference niches – but I didn’t met any resistance. I found them by using google. I type in what i’m looking for and then start at like page 10 or so (depending on the number of results). Good true wholesalers aren’t SEO masters and most likely will not be in your top results. They also will not typically have ‘nice’ websites. And they almost always will not have prices displayed. If you can see their prices without opening an account and providing a tax id – then they are not true wholesalers.

My plan is to first create a website – to make me look a little more legitimate. It’s almost done – so I’ll share once I’m finished.

Great post. Can you tell us how much money you started with? I’m trying to understand the other benefits of using a prep center; Isn’t is expensive? You just started, wouldn’t it take a huge part of your profits?

Anne

Hi Anne – My first purchases in Jan I spent about $500 – but I decided to ramp that up rather quickly and I took money from savings and spent about $5,000 in Feb. That included inventory, supplies, some software, training course (which I didn’t really need) and paying for a conference I went to. I invested more capital because I wanted to grow quicker.

As for using a prep center – I’m a believer for sure. But it really depends on your goals. IMO, there is no way to really scale unless you outsource. You have to know your weakness and strengths. For me – I’m an idea person – which means I suck at follow-through. With the prep center I can spend more of my time on new ideas and let them handle the follow-through. I was spending 2 days a week prepping/listing and shipping and now I use those 2 days for other things – like sourcing or streamlining processes so I can move on to the next idea.

Does it take part of my profit? – sort-of. I’m using a prep center in a no-sales tax state – which means it almost pays for itself. Their price also includes all supplies – so I’m not spending money on that. I also include their cost in my COGS – so when I’m sourcing I’m already factoring it in – and thus I source items with a higher ROI. I also value my time at a pretty high rate. If I factor that in – then I’m actually making money with a prep center, I couldn’t afford myself – lol!

Inspiring! Good Luck on your way to achieving your goals 🙂

Dana,

This is great and very inspiring. I’m not there yet but hope to be very soon. Two things you mentioned stood out to me: using an actual accounting software and selling items that with higher sell price. I was going to use IL for my accounting but I’ll check out Quickbooks. Also, ideally I like to make no less than $15 net profit on an item. I tried the lower price higher volume model and that’s not the one for me. I prefer to sell one thing and net $30 than having to sell 6 things to get the same amount.

Finally, I just did the same thing with a bunch of my inventory that I purchased early on in ignorance-priced it to move. I’ve been able to sell off most of it with VERY little profit on most but like you said at least I am able to get my money back to purchase better inventory.

CJ

Thanks Ryan for the post. I look forward to more.

Hey CJ – thanks for the comment. I do use both IL and QB – which might be overkill but I like numbers (even if I’m not very good with them). I like IL because of the quick look at COGS and tracking profitability by SKU and Supplier. But I use QB for P/L and Balance Sheets. IL does have a P/L report – but technically it’s not a ‘true’ P/L in an accounting sense. For example, IL includes mileages expense in the P/L report – and technically mileage is a tax deduction and shouldn’t be included as an expense. If you plan to just turn things over to an accountant IL might be enough. But I generally do my own accounting (or at least do as much as I can – before having my accountant take a final look). Good Luck!!

None of the photos are showing up!

Sorry about that, should be good to go now.

Best Regards,

Ryan